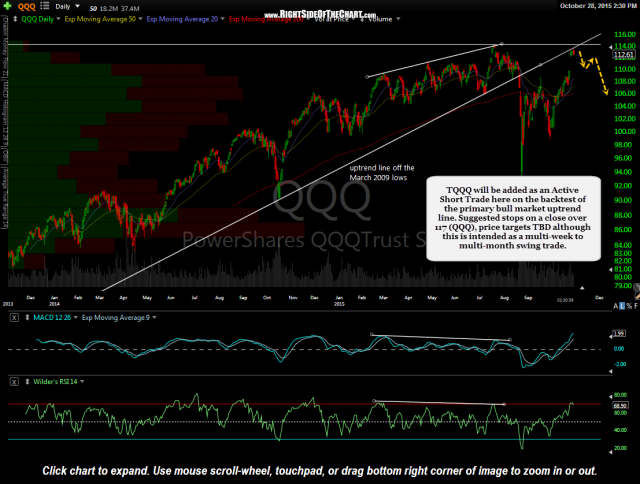

TQQQ (3x bullish Nasdaq 100 ETF) will be added as an Active Short Trade here (TQQQ roughly at 117.50 now) on the backtest of the primary bull market uptrend line. Suggested stops on a close over 117 (on QQQ), price targets TBD although this is intended as a multi-week to multi-month swing trade.

- QQQ daily Oct 28th

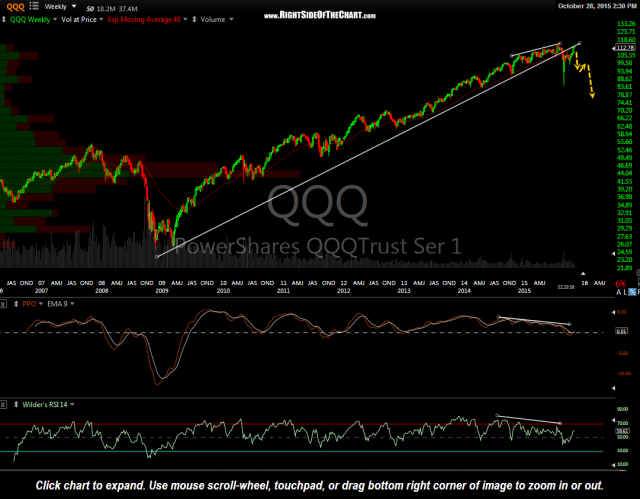

- QQQ weekly Oct 28t

SQQQ (3x short $NDX) would only be a viable option for those looking for a short-term trade lasting just days to no more than a few weeks at most due to the price decay suffered from leveraged etfs when held for extended periods of time (hence, the reason for shorting TQQQ). Other options for shorting the $NDX (other than NQ emini futures & QQQ options) would be a raw short on QQQ or QLD (2x long $NDX) as well as a long in QID (2x short $NDX), which, in theory, should suffer less decay than SQQQ due to the lower amount of leverage. As always, make sure to adjust your position size to account for the use of leverage on any instrument that you are trading & always pass on trades that are not inline with your own objectives & risk tolerance.

Finally, this should be considered a somewhat aggressive, anticipatory trade as the $NDX has yet to even move below Friday’s highs. A more conventional entry could be made (or an initial short here added to) on a break below any of the key support levels recently posted on the $NDX 120-minute chart.