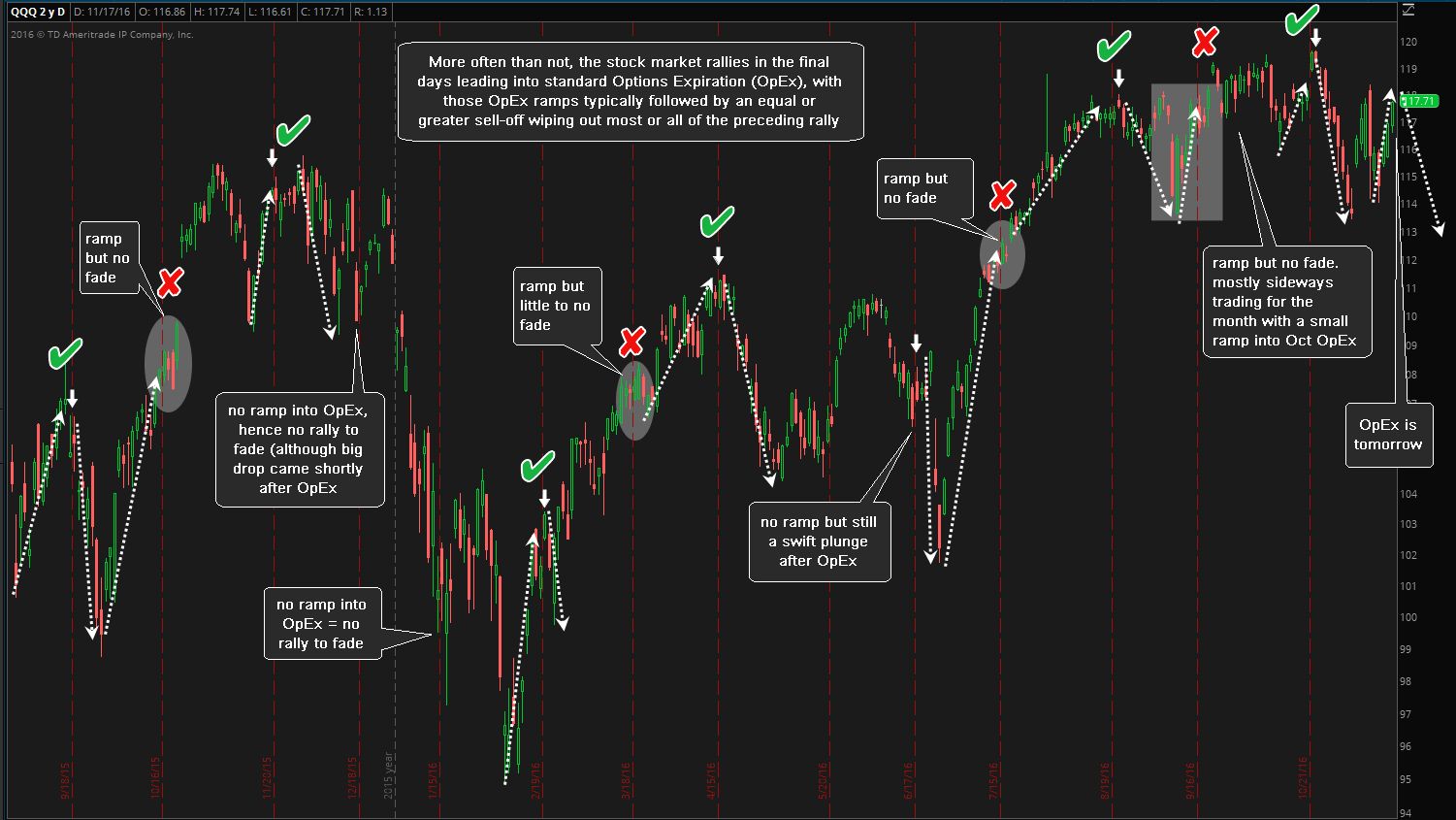

A quick update on what I often refer to as the ‘OpEx Ramp’; a fairly consistent pattern in recent years of the market rallying into standard Options Expiration (3rd Friday of each month), only to be followed with what is often an equal or greater sell-off wiping out most or all of the proceeding rally.

As with any historical pattern in the market, such as historical seasonality stock market performance, the OpEx ramp (and subsequent sell-off) is far from 100% reliable as a predictive indicator but has played out more often than not, especially when backing out those periods that followed in the month or two after strong corrections in the market, such as was the case in the first 3 of the 4 red “X’s” on this chart that highlight the periods where market ramps leading into OpEx were not followed with a sharp correction shortly after OpEx.

That certainly isn’t the case this month as the market has been trading in a relatively tight sideways trading range for over 4 months now, with the last decent correction in the market occurring back in June. As such, I believe the odds strongly favor a decent sell-off that begins sometime next week as tomorrow is standard options expiration for the November contracts. The average post-OpEx ramp fade typically kicks off anywhere from immediately (i.e.- the Monday after OpEx) up to about 5 or 6 trading sessions later with the bulk of the fades staring within just a couple of trading sessions after OpEx.

Couple the history of market fades following OpEx ramps with the fact that starting next week, the stock market will only have less than 16 full trading session in which to throw a hissy-fit before the next FOMC meeting begins, something it has always done in recent years anytime the probability of a rate hike in order to let Momma Yellen know that her baby (the stock market) is going to scream & yell if she dare not give it exactly what it wants. Those two factors together, along with the fact that the odds of a rate hike are currently over 90%, put the odds for a sharp sell-0ff in equities over the next 2-3 weeks about as good as it gets IMO.