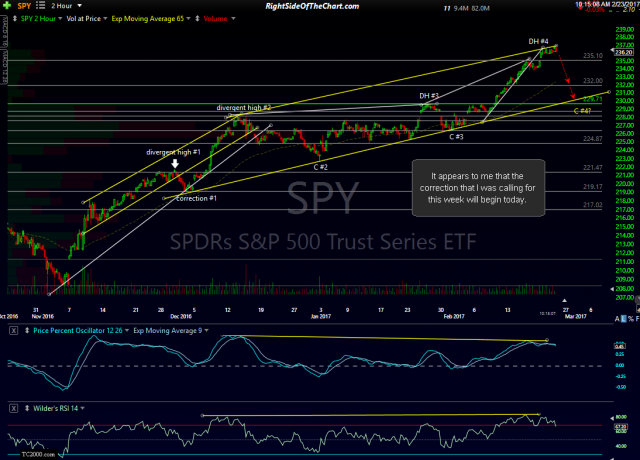

As a follow-up to last week’s post OpEx Ramp In Effect, Fade Likely To Begin Next Week, it appears to me that the correction that I was expecting to happen this week will most likely begin today with the markets closing significantly lower, quite likely printing a bearish engulfing candlestick. If that does occur, it will come on the heels of yesterday’s Inside Days on the S&P 500 & Nasdaq Composite, which I had pointed out in the XLF/Financial Sector video published earlier today.

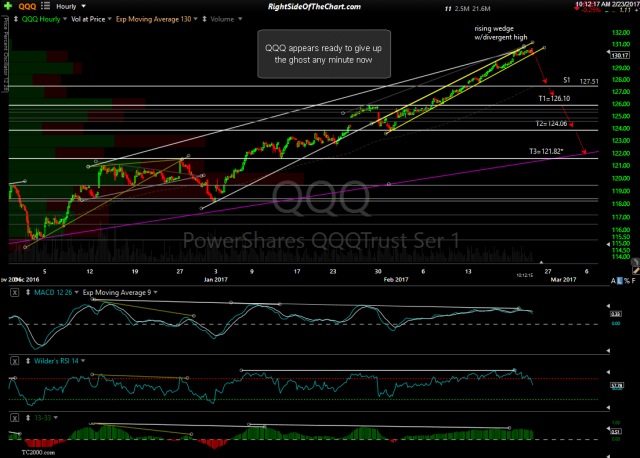

- QQQ 60-min Feb 23rd

- SPY 120-min Feb 23rd

Of course, the day is young so let’s just see how things play out today but based on the 60-minute & 120-minute charts of QQQ & SPY above in addition to all of the supporting evidence for a market reversal/correction recently posted, I would say this is as good a time as any to initiate or increase short exposure on the broad market or any sectors or individual stocks that stand out.