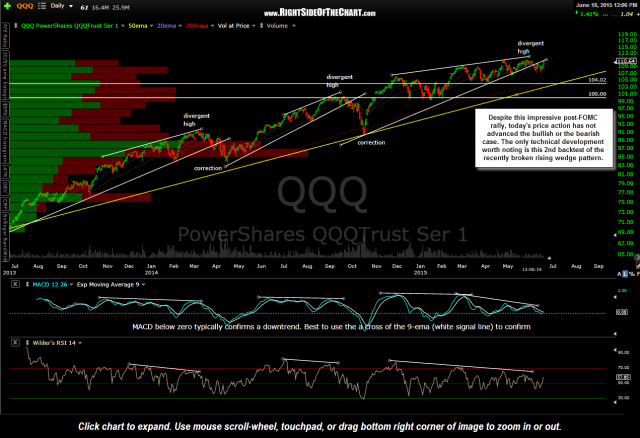

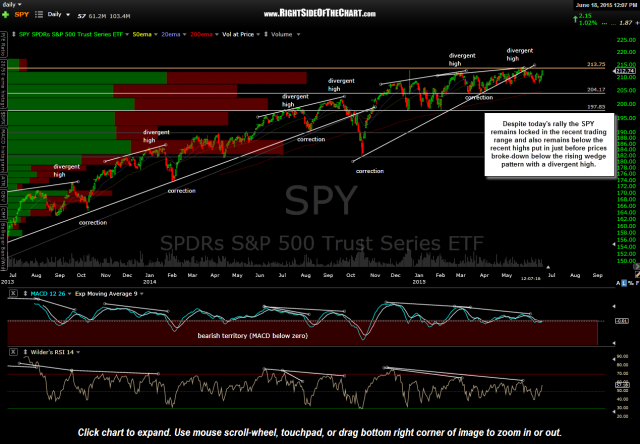

Despite this impressive post-FOMC rally, today’s price action has not advanced the bullish nor the bearish case. The only technical development worth noting is this 2nd backtest of the recently broken rising wedge pattern. The overall technical posture of the US markets still indicates more downside to come in the following weeks/months, even if the large cap indices manage to eek out marginal new highs (which they have yet to do, despite today’s rally).

While the larger technical posture of the markets indicates a trend reversal is likely, the primary trend remains bullish with the near-term (for the last several months) trend sideways. As such, I continue to wait for a break below the June 9th lows in both the SPY and QQQ before adding any short exposure to the broad markets.

- QQQ daily June 18th

- SPY daily June 18th