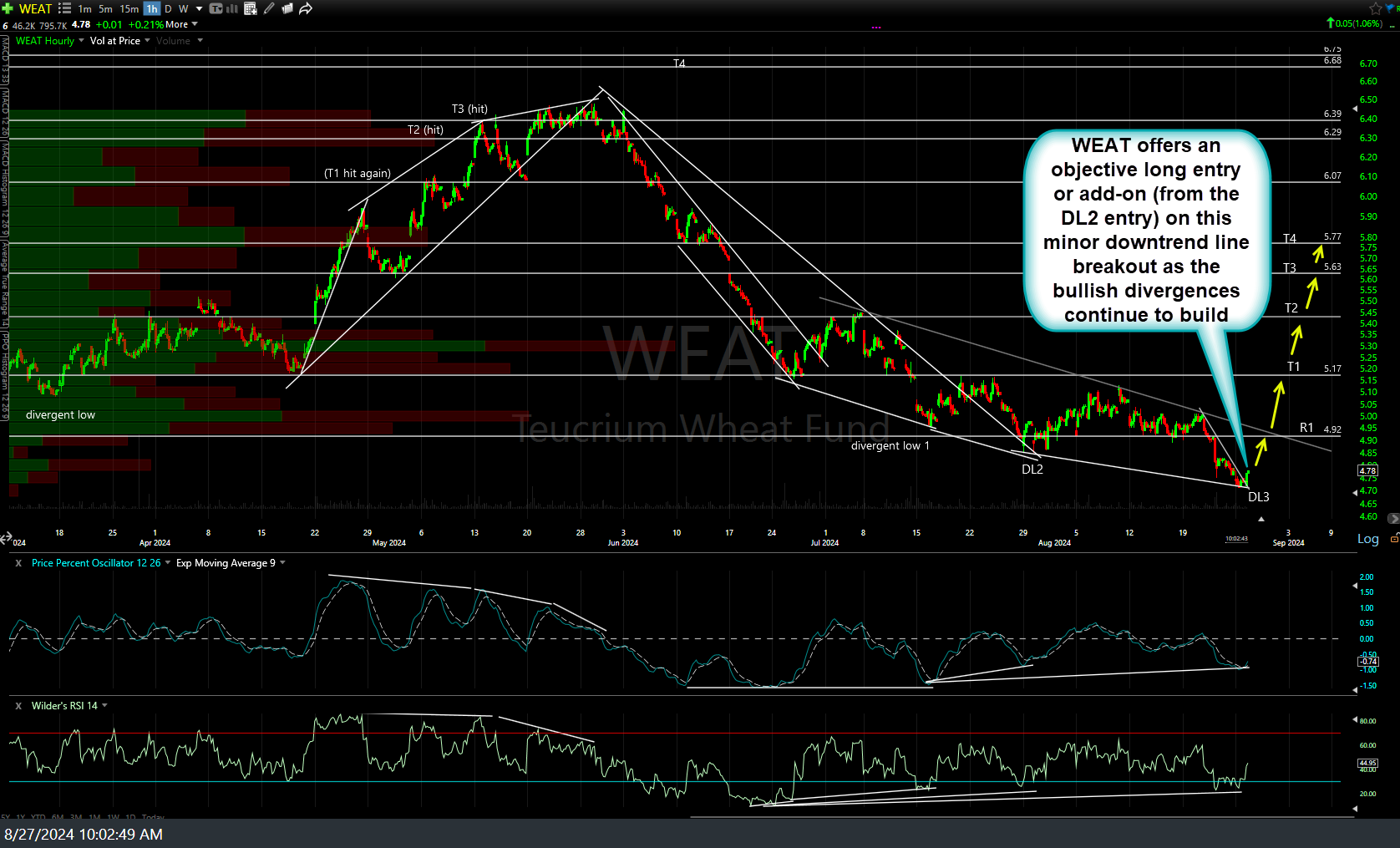

WEAT (wheat ETN) offers an objective long entry or add-on (from the DL2 entry) on this minor downtrend line breakout as the bullish divergences continue to build. Previous (July 30th) & updated 60-minute charts below.

The last objective long entry was highlighted about a month ago (July 30th) when WEAT was backtesting the downtrend line after putting in a divergent low. WEAT has drifted sideways to slightly lower (~2% vs. about 20% upside potential to T4 so well within any reasonable stop parameters) since then with the positive divergences continuing to build.

For futures traders, /ZW (wheat futures) also offers an objective long entry or add-on with this breakout above the 60-minute bullish falling wedge pattern following the most recent divergent low.

While the charts above support the technical case for a trend reversal in wheat, a bullish fundamental case can also be made for rising commodity prices, particularly those that were beat down the most from the previous rate-hiking cycle (such as select agricultural commodities, particularly the grains) now that a Fed pivot (rate cutting cycle to begin in Sept) has finally been solidified.