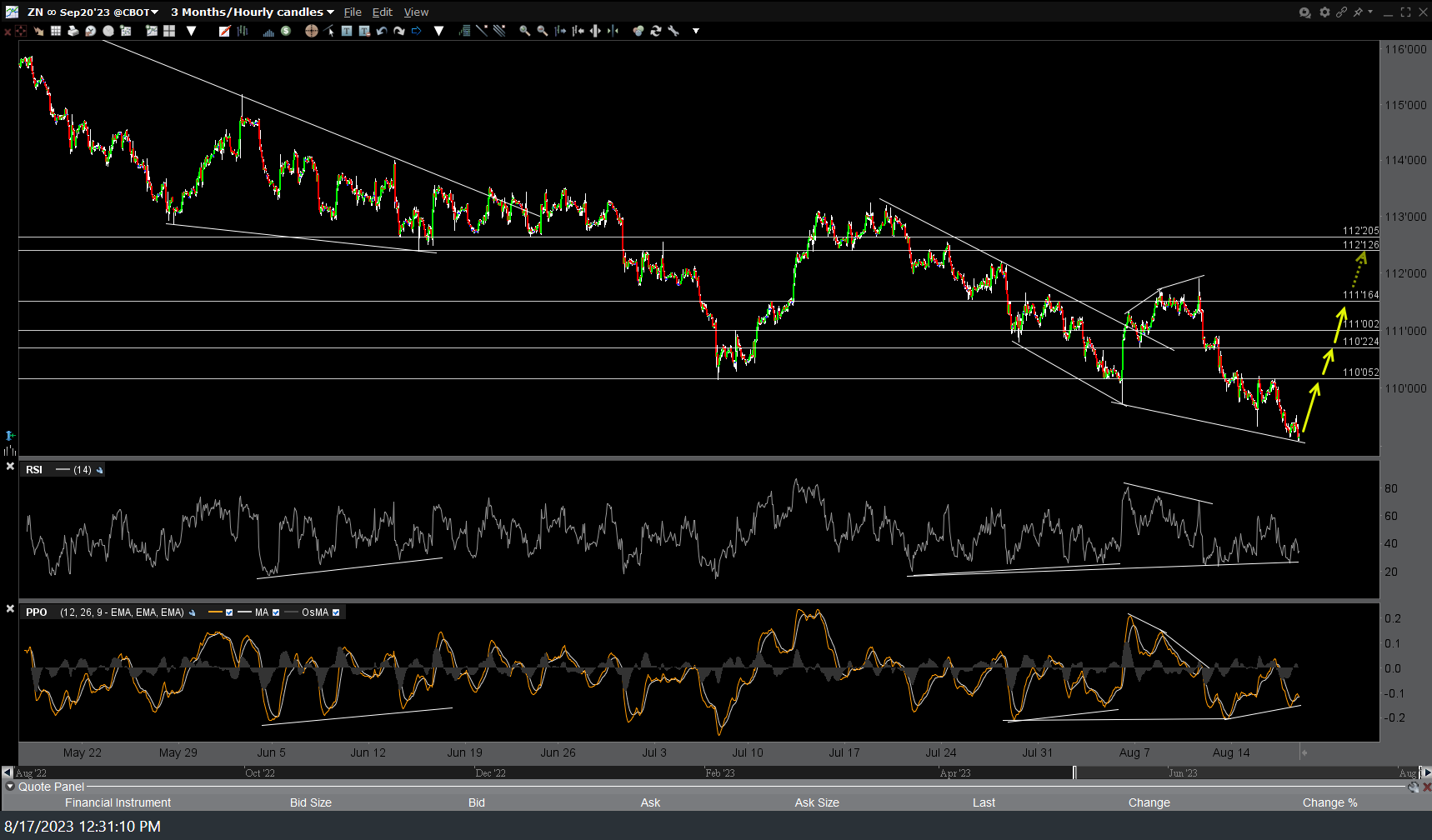

IEF (7-1o-yr Treasury bond ETF) & /ZN (10-yr T-bond futures) appears poised to rally following this divergent low on the 60-minute time frame coupled with the 10-yr yield ($TNX) hitting technically significant Oct 21, 2022 multi-year high, as covered in today’s video. Price targets/resistance levels shown on the 60-minute charts below. Suggested stops inline with one’s preferred price target(s) using a favorable R/R of 2:1 or better. Due to the inherently low volatility of 10-yr Treasury bonds coupled with the below-average gain/loss potential, I typical use a beta-adjusted position size of 2.0 (i.e.- about twice the size of a typical position in SPY).

On a somewhat related note, I suspect that the 10-year yield will start to fall soon (which would mean 10-yr bond prices..IEF & /ZN.. up) & if so, that would likely be one of the catalysts for a rally in the stock market. Otherwise, should yields continue to rise, that will most likely put additional pressure on the stock market. Hence, to be long the both 10-yr & long the stock market at this time would most likely (but far from guaranteed) be a positively correlated trade. As such, that should be a consideration in overall (stock index & T-bond positions combined) position sizing within one’s portfolio at this time IMO.