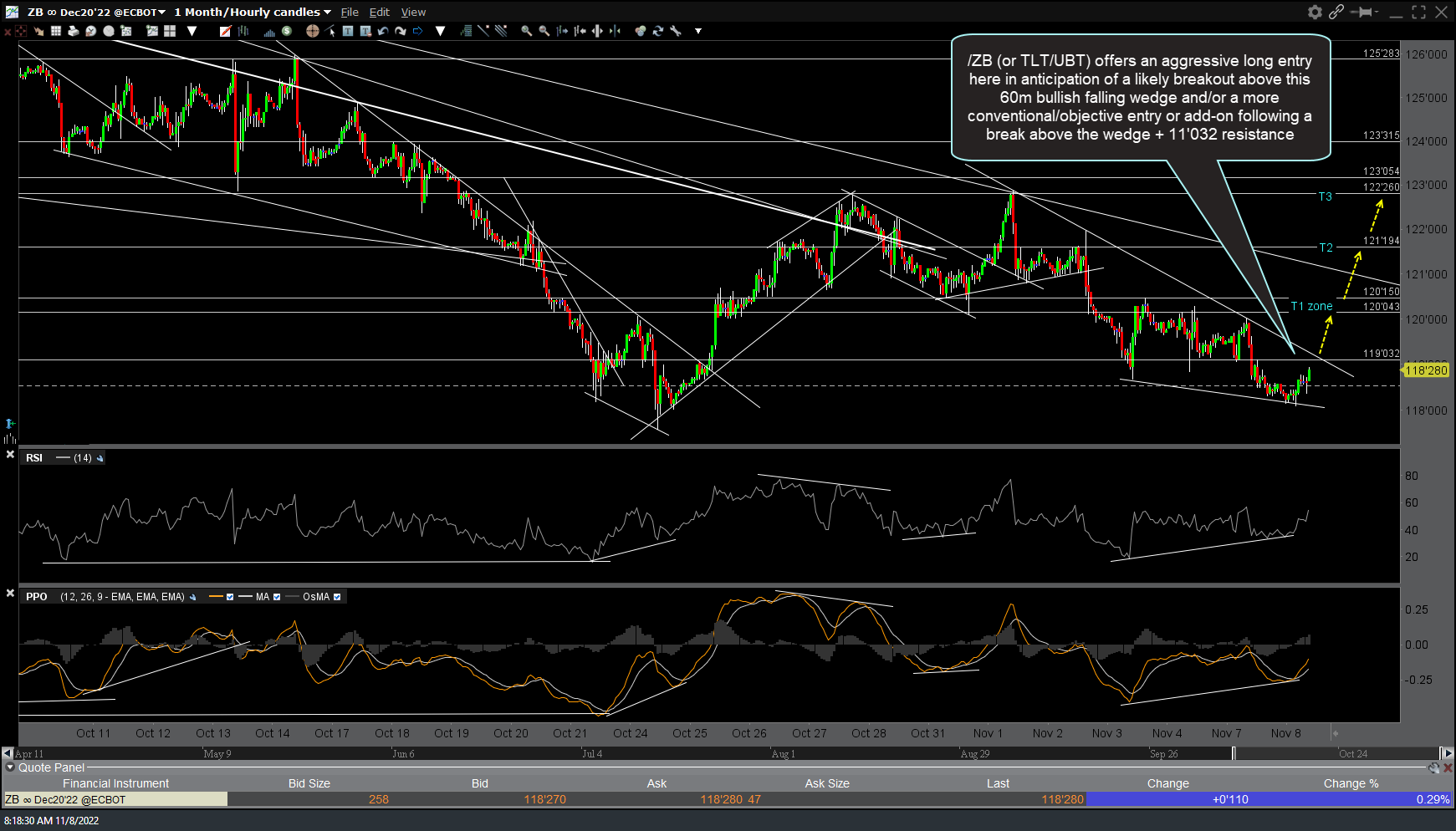

The /ZB (30-yr Treasury bond futures or TLT +1x/UBT +2x ETF) swing trade just hit T3, the final near-term target for the swing trade entered Tuesday where the odds for a reaction are likely. As always, best to set your sell limit order on long trades slightly below the actual resistance level you are targeting in case the sellers step in earlier (hence, this is an effective hit of T3 as /ZB is just shy of that level right now). Initial & updated 60-minute charts below.

Likewise, /ZN (10 yr T-bond futures) has rallied into the comparable resistance (T3) as /ZB, where a reaction is likely before the next leg up.

Bottom line: I remain intermediate-term bullish on Treasuries but it appears that the odds for a reaction (i.e.- a consolidation and/or pullback) are elevated at this time and, as such, this would be an objective time for active traders to either book profits or raise stops to protect gains, if holding out for additional upside.