/ZB (30-yr T-bond futures) or TLT (20-30 yr Treasury Bond ETF) offers an objective long entry here at the 159 support level for a bounce trade up to either of the two price targets on the 60-minute charts below -or- to just before the FOMC rate decision announcement at 2pm EST next Wednesday, whichever comes first.

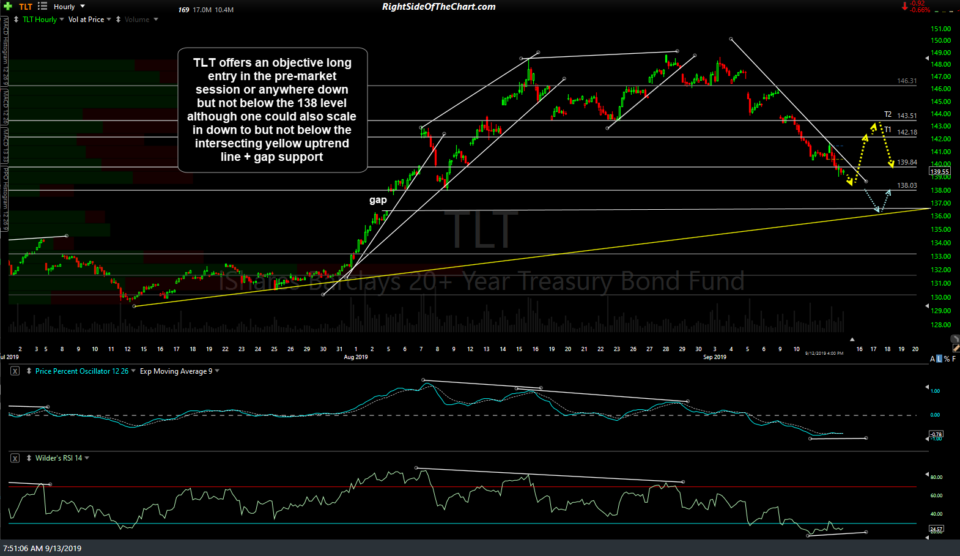

TLT offers an objective long entry in the pre-market session (trading between 138.69-139.15 so far today) or anywhere down but not below the 138 support level although one could also scale in down to but not below the intersecting yellow uptrend line + gap support.

Due to the shorter than usual time frame (2-3½% days) plus relatively small price potential (3-4%, although one can take a 2x or larger position in Treasuries due to the lower volatility than equities, hence a 6-8%+ beta-adjusted return potential), I am passing this along as an unofficial trade idea. Unofficial trades typically don’t list explicit price targets & suggested stops as the official trades due. As such, these are unadjusted price targets, meaning those are the actual resistance levels where a reaction is likely. As such, best to set your set limit order(s) slightly below the resistance level that you are targeting to help minimize the chances of missing a fill, should /ZB or TLT reverse just shy of resistance.