I was bullish Treasury bonds before leaving for vacation, both as a direct play as well as an indirect hedge to any index shorts. However, TLT (20-30 yr Treasury bond ETF) has hit the 94.68 target/resistance level on the daily chart where the odds for a reaction are elevated. Additionally, the PPO signal line, which does a good job of defining bullish & bearish trends (when above or below the zero line), is currently backtesting the zero line from below. As such, a rejection here would keep the intermediate-term bearish trend intact (the short-term trend is still bullish) while a solid recovery of the PPO signal line back above the zero line, in conjunction with a solid break above 95 on TLT, would be bullish.

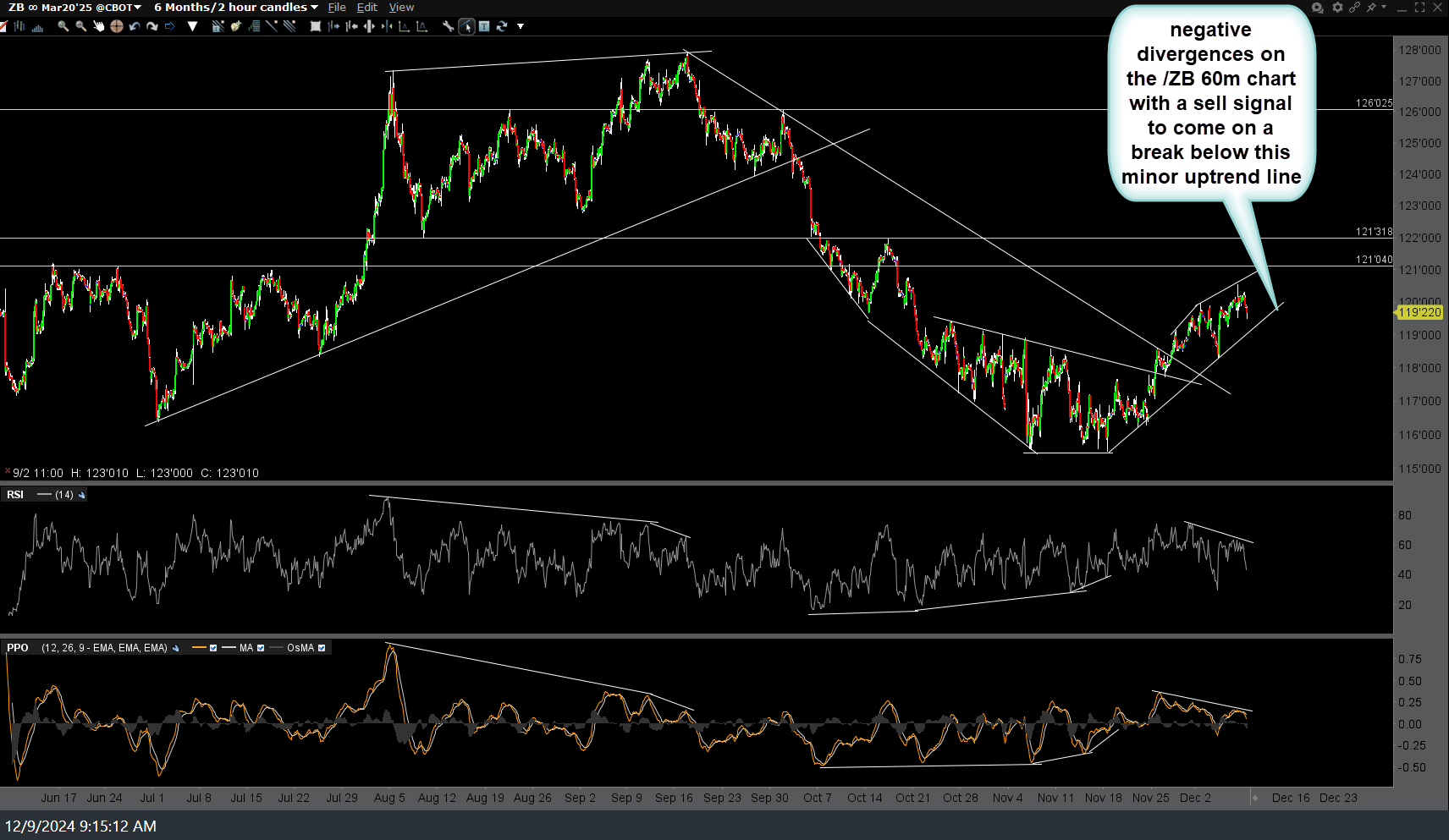

TLT daily chart above, /ZB 120-minute (6-months of price history) chart for reference below. My preference would be to close out the TLT/ZB trade as I no longer feel the R/R to remain long is favorable, or at least tighten up stops if holding out for additional gains.