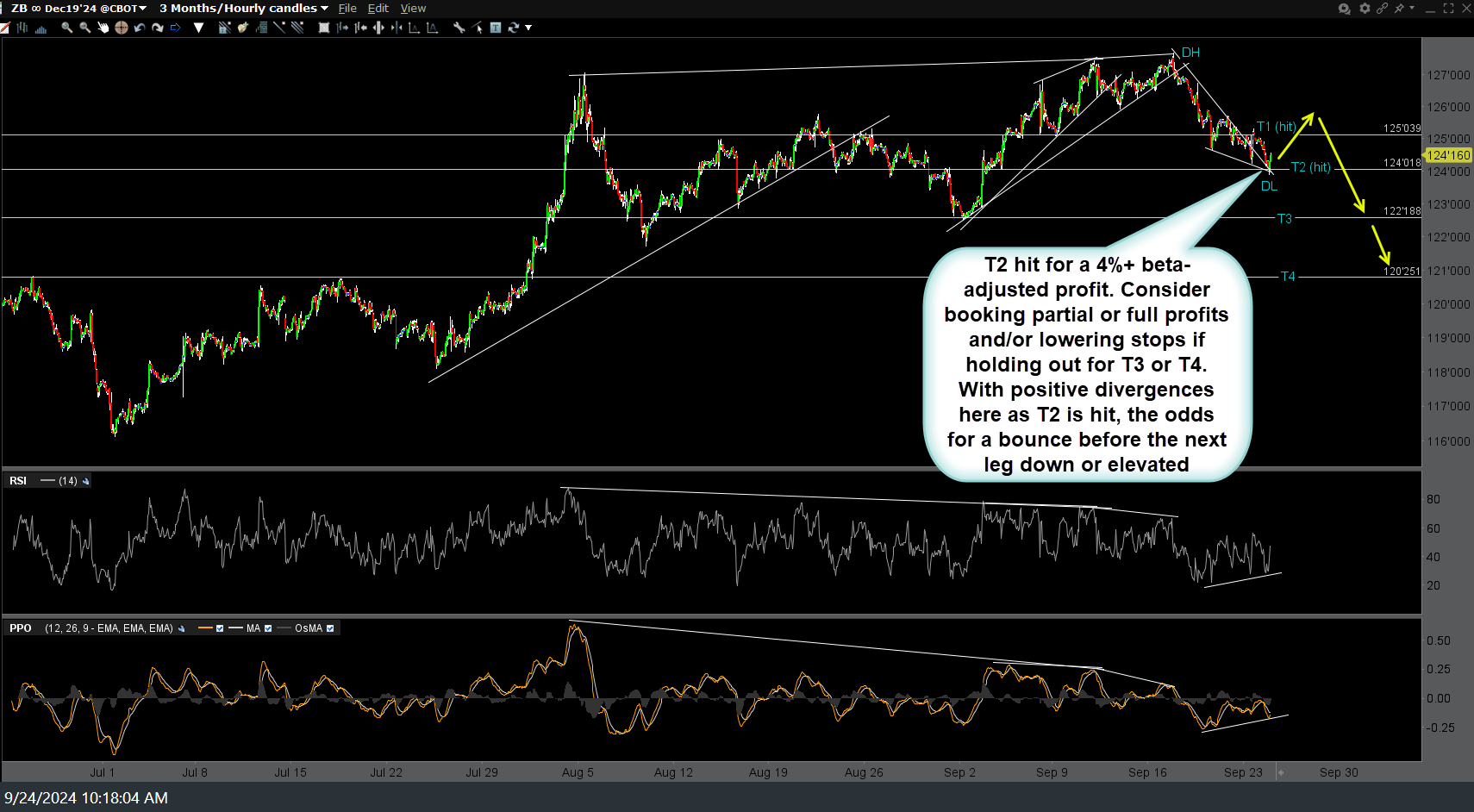

The /ZB (30-yr Treasury bond futures) short swing trade has hit T2 for a 4%+ beta-adjusted profit. Consider booking partial or full profits and/or lowering stops if holding out for T3 or T4. With positive divergences here as T2 is hit, the odds for a bounce before the next leg down or elevated. 60-minute chart below.

While I didn’t have a comparable price target marked up on the 60-minute chart of the TLT (20-30 yr Treasury bond ETF) alternative trade, the fact that /ZB just hit T2 (support) where a reaction is likely before the next leg down also increases the odds for a bounce in TLT. Updated 60-minute chart below.