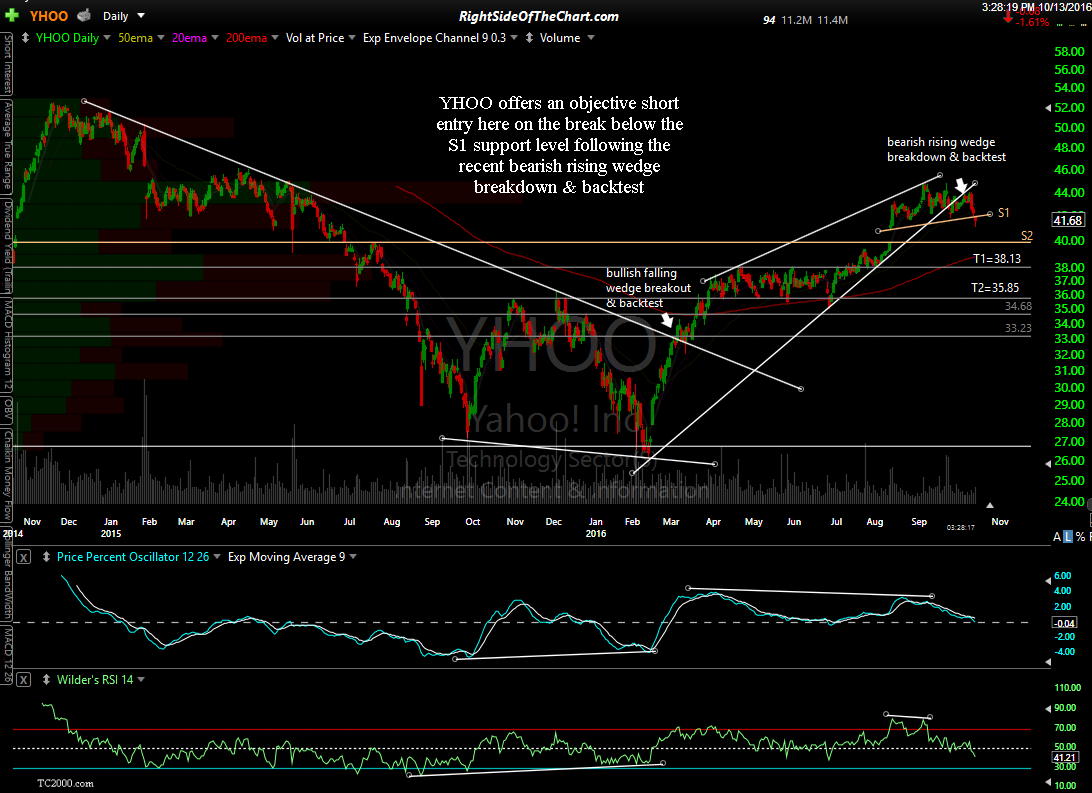

YHOO (Yahoo! Inc) offers an objective short entry here on the break below the S1 support level following the recent bearish rising wedge breakdown & backtest. Suggest stop above 44.45 with a suggested beta-adjustment of 0.9. T1 is 38.13 with the final target, T2, at 35.85.

YHOO Trade Entry & Setup

Share this! (member restricted content requires registration)

5 Comments