XLY (Consumer Discretionary ETF) offers an objective short entry following the breakdown & backtest of this bearish rising wedge pattern with XLY to be added as an Active Short Swing Trade around current levels.

One could also opt to wait for a break below the 60-min TL & 110.45 support level for a more conservative entry with a higher probability of success, albeit less favorable entry price.

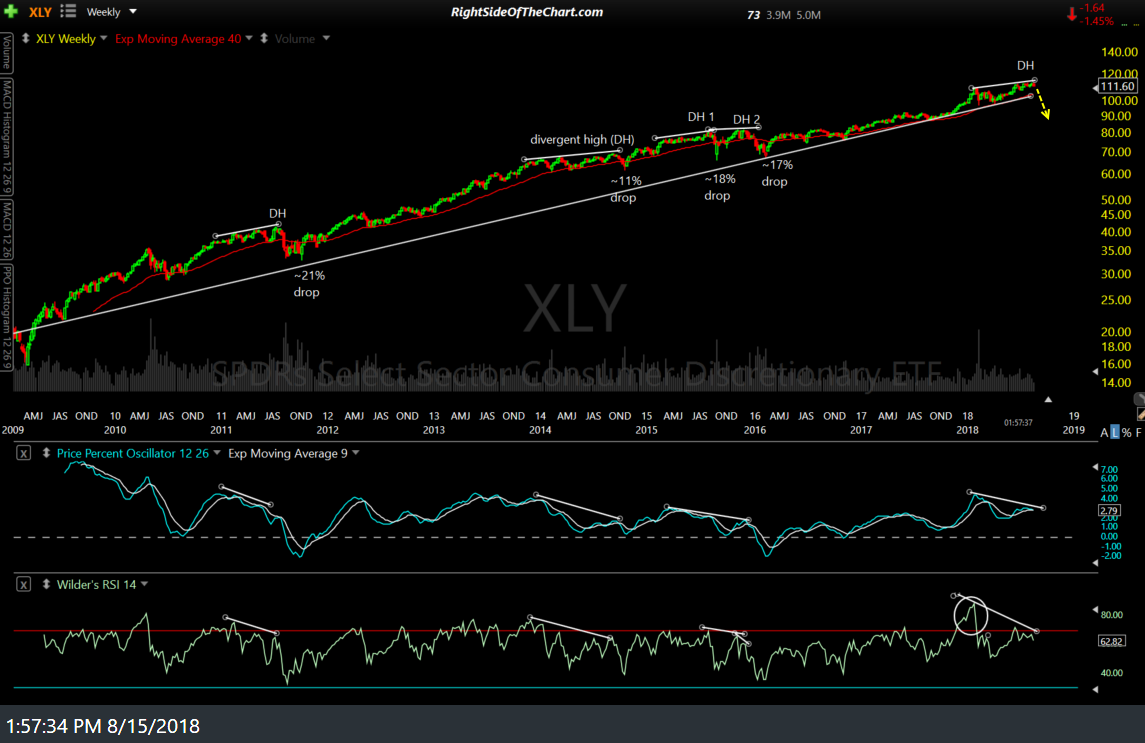

The 10-year weekly chart below highlights the current negative divergence in place along with the previous divergent highs over the past decade, all of which have been followed by corrections ranging from 11% – 21%. It should also be noted that should these current divergences play out for a double-digit correction, that will most likely take the consumer discretionary sector below the multi-year primary uptrend line. If so, that could have longer-term bearish implications on the sector.

The price targets for this trade are T1, which will be the uptrend line generated off the February 2016 lows, T2 at 99.94 & T3 at 92.76. As the price level of a trendline is dynamic, I am unable to provide an exact price target at this time although I will say that if XLY does pullback to that level from here & does so in the expected time frame of about two weeks from today, that TL would come in around the 104.60 area, a drop of roughly 6% from where XLY is currently trading. The suggested stop for this trade is any move above 117.50 and the suggested beta-adjusted position size is 1.0 (i.e.- a typical position size).

One should also be aware that a short on XLY is effectively a short on one of the market’s most beloved stocks, Amazon.com as AMZN accounts for just over a 25% weighting in XLY. I will say that although I have not received a sell signal on AMZN yet, it appears to me that the stock is within days of printing a significant top as Amazon grinds its way towards the apex of this bearish rising wedge pattern, complete with negative divergences confirming the bearish nature of the wedge pattern.

I have also reviewed the charts of all individual components of XLY and it appears that the majority of stocks within the consumer discretionary sector have recently broken down or are currently poised to do so. I may follow up with video coverage of the sector soon.