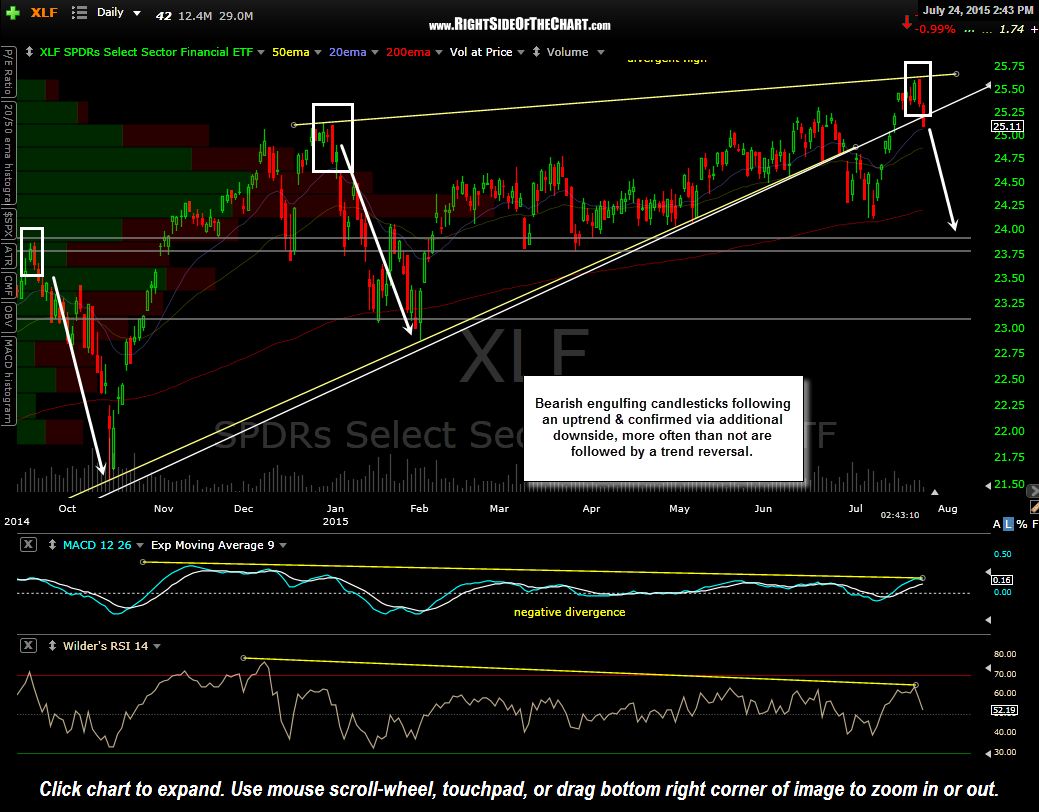

XLF (financial sector etf) and FAS (3x long financials etf) will once again be added as Active Short Trades following yesterday’s bearish engulfing candlestick. In the yesterday’s video covering the semi-conductor sector I had highlighted that potentially topping candlestick pattern in XLF & as often stated, it is best to wait for additional confirmation with prices moving lower in the trading session(s) following a bearish engulfing candlestick. Today we clearly have confirmation with the financials trading down sharply. Add to that the fact that following a brief whipsaw sell signal, which was followed by XLF moving back above the primary downtrend line, as of today XLF is once again trading below that key uptrend line (support).

Bearish engulfing candlesticks, following a long uptrend & confirmed via additional downside, such as the one pointed out on April 28th when AAPL printed it’s all-time high nearly 3 months ago, offer one of the better R/R short entries (assuming they are confirmed with additional bearish technicals, as was the case with AAPL & as is currently the case with XLF). This zoomed-in daily chart of XLF shows the two previous corrections in the financials (10% & 9%), with both tops accompanied by an “confirmed” engulfing candlestick.

The recent XLF/FAS short trade exceeded the suggested stop on Thursday when XLF made a marginal new high. As such, that previous trade was stopped out (and will be updated soon, along with a few other recently stopped out trades). XLF (or FAS) both offer objective entries for a new short trade here with a suggested stop over the recent highs (yesterday’s high 25.62 in XLF) with a sole profit target of 23.15 (additional targets likely to be added).