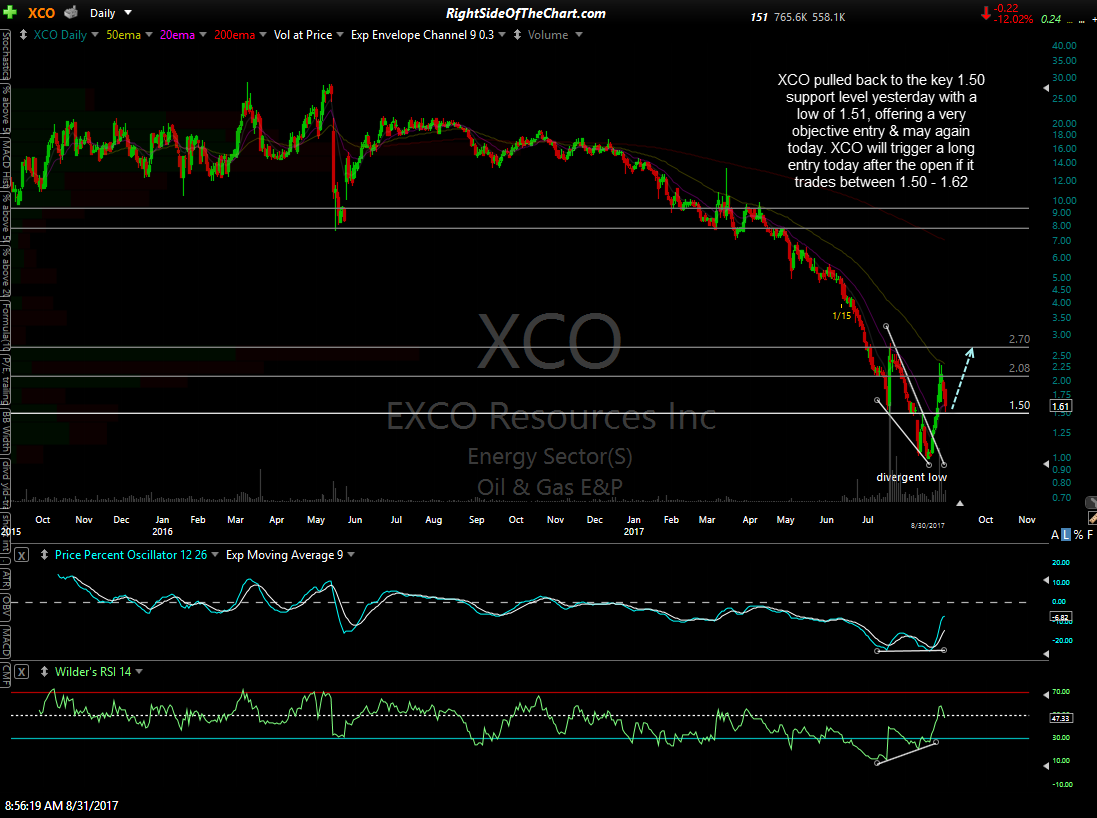

XCO (EXCO Resources Inc) was recently posted as an unofficial trade idea in the trading room last week while trading at 1.35. The stock exploded from there, gaining 75% over the next 3 trading sessions with a brief momentum-fueled overshoot of the 2nd price target before reversing. The stock has since pulled back, working off the near-term overbought conditions. XCO hit a low of low of 1.51 yesterday, just 1 cent above the key 1.50 support level, offering a very objective entry & may again today. I missed this one when my internet was down yesterday or would have added to my position but plan to do so today.

XCO will trigger a long entry today after the open if it trades between 1.50 – 1.62. The price targets are T1 at 1.98 & T2 at 2.62 with the potential for additional targets to be added if the charts of XCO as well as XOP (Oil & Gas Exploration & Production ETF) continue to firm up. The suggested stop will be any move below 1.35 with a suggested beta-adjustment of 0.40, due to the extremely high volatility & aggressive nature of this trade.