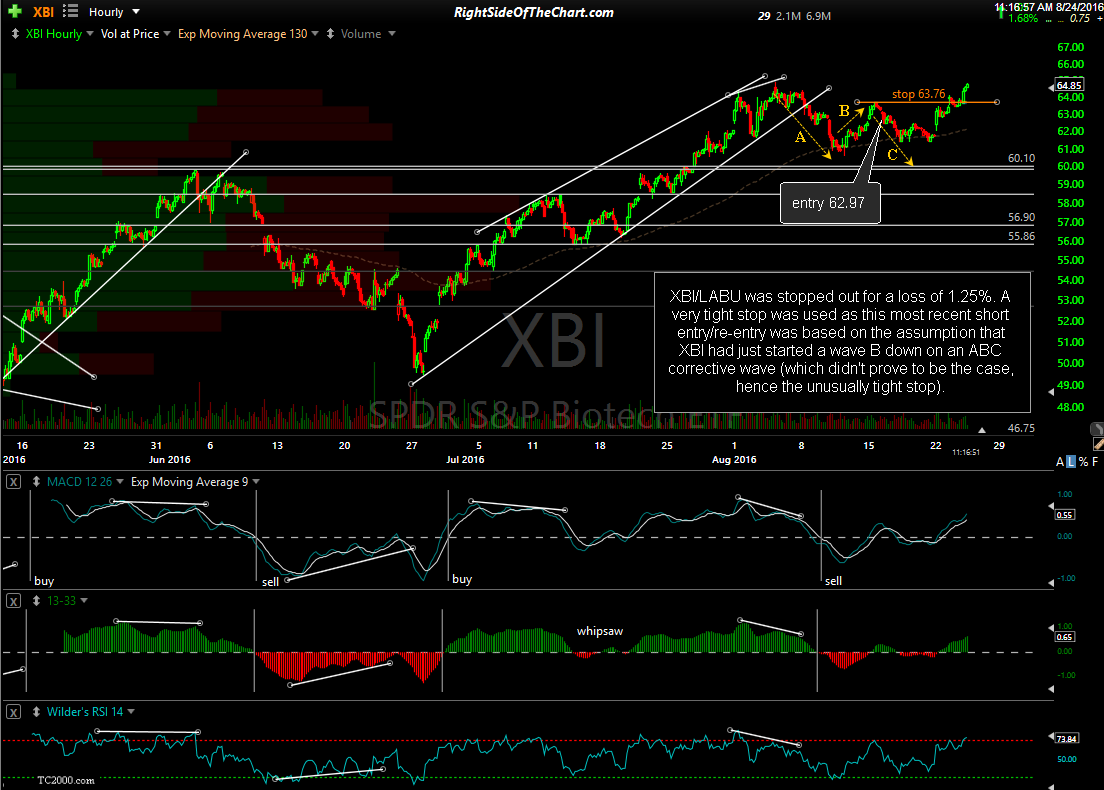

The most recent XBI/LABU short trade was stopped out for a minor loss of 1.25%. A very tight stop was used as this most recent short entry/re-entry was based on the assumption that XBI had just started a wave B down on an ABC corrective wave (which didn’t prove to be the case, hence the unusually tight stop). 60-minute chart:

XBI/LABU Stopped Out

Share this! (member restricted content requires registration)

5 Comments