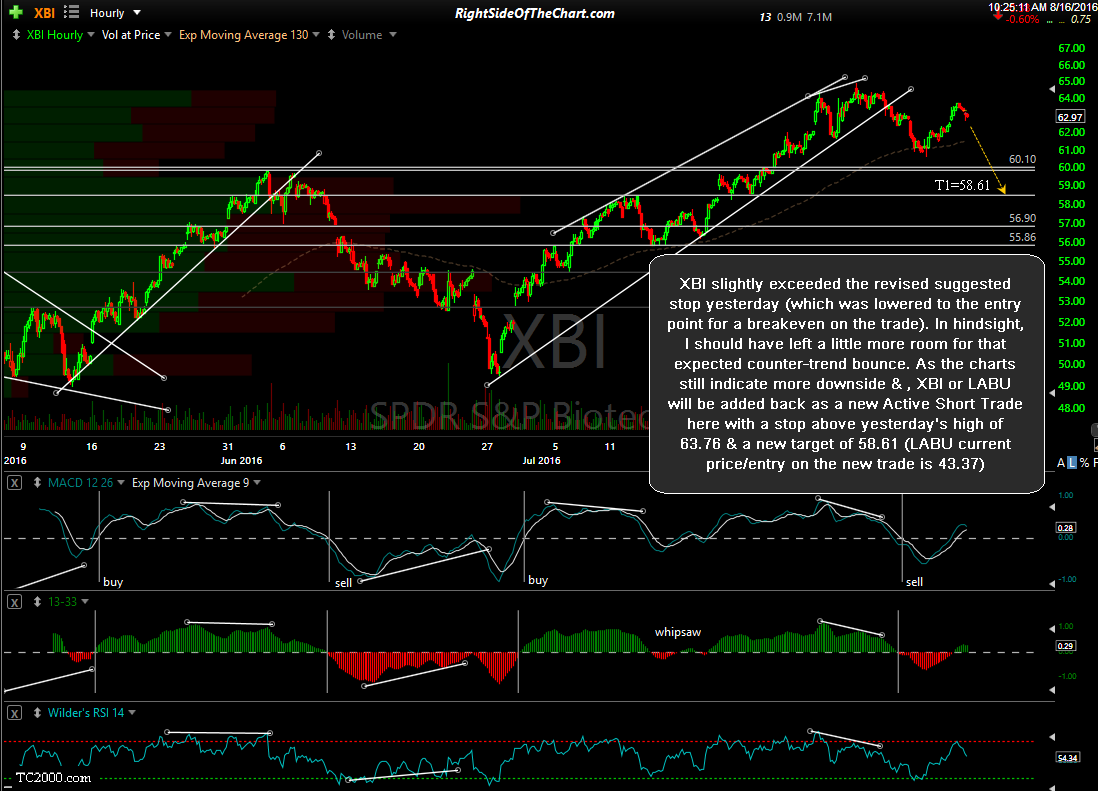

XBI slightly exceeded the revised suggested stop yesterday (which was lowered to the entry point for a breakeven on the trade). In hindsight, l should have left a little more room for that expected counter-trend bounce. As the charts still indicate more downside, XBI or LABU will be added back as a new Active Short Trade here with a stop above yesterday’s high of 63.76 & a new price target of 58.61 (LABU current price/entry on the new trade is 43.37). Updated 60-minute chart.

More of the rationale behind my thoughts on this trade are explained in Friday’s video update of the XBI/LABU which can be viewed by clicking here.