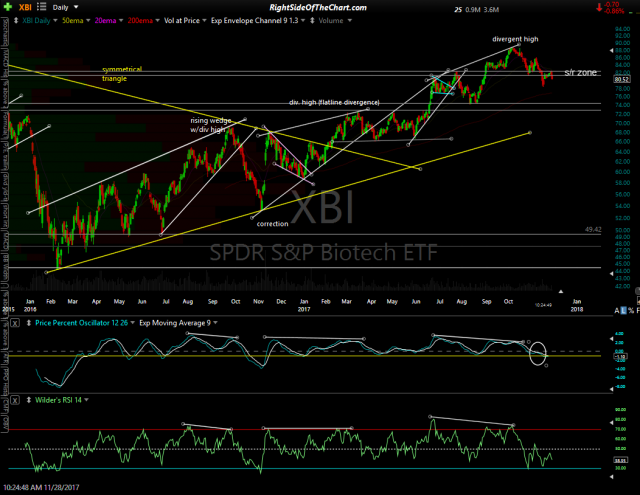

Member @natdicarlo requested an update on the biotech sector (XBI/IBB) within the trading room. XBI was recently rejected near the top of the former support, now resistance zone & has moved back below it which is bearish. That 60-min resistance zone was also a key support zone on the more significant daily chart so the biotechs are in a precarious position right now. Watching the adjust PPO bullish/bearish line (yellow) which I covered in a recent video. Bullish if the PPO signal line bounces off this test, bearish if it makes a definitive cross below. Daily RSI is oversold & the PPO trend indicator still bullish for now so I don’t care to short the biotechs nor do I want to be long here either. Still standing aside that trade other than a few select individual stocks. Previous & updated 60-minute charts below:

- XBI 60-min Oct 20th

- XBI 60-min Nov 28th

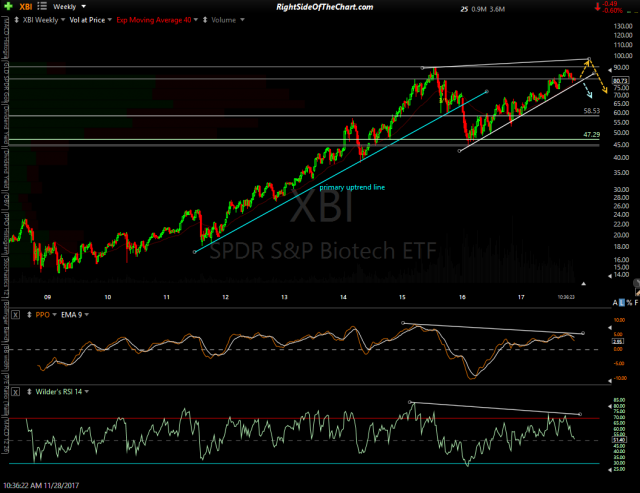

The daily chart & weekly charts of XBI are posted below. On the weekly chart, note that XBI is approaching key uptrend line support. As the recent high fell just shy of the previous reaction/all-time high from mid-2015, we don’t have negative divergence on that time frame as of now. Should XBI bounce off the trendline once more & go on to make a marginal new high before breaking down below it, that would have put in confirmed negative divergence (orange scenario), setting the stage for a potentially powerful bear market in the biotech sector.

- XBI daily Nov 28th

- XBI weekly Nov 28th

Keep in mind that even a marginal new high in the biotechs (above the 2015 high) could mean another 15%+ upside from here. The biotechs may or may not make another new high before moving much lower but whether or not they do, an impulsive break & weekly close below that trendline would be a powerful sell signal for the biotechs.