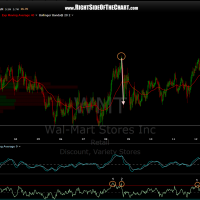

like so many of the recently updated short trades, WMT looks as good or better now than it did upon entry a few weeks back. since the bearish rising wedge breakdown and re-test, WMT failed to make new highs (unlike the broad market) and has since put in additional divergences on that double-top failure. basically, this trade is flat right now so we are far from declaring victory. i will leave the official stop on a solid move above the recent highs although personally i will allow WMT a larger buffer (6-8%) above that level before covering my short.

the 6 day period (each candlestick represents 6-days vs. 5-days on a weekly chart), shows that overbought readings of this magnitude, especially when recently preceded by another overbought reading, has lead to extremely deep & sharp corrections in very short order. as such, the targets for the WMT short trade may very well be extended once/if the trade starts to pan out and especially a strong downtrend begins to take shape in the broad markets. updated 4 hour chart along with the 6-day chart.