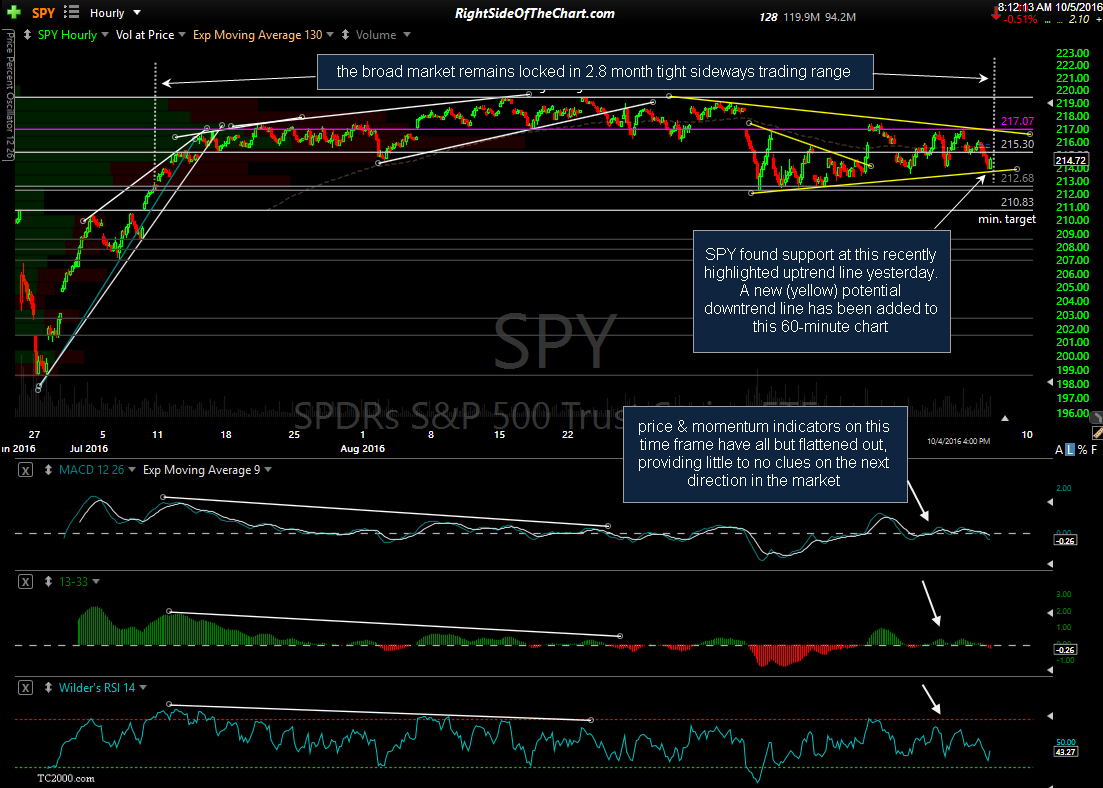

Not much to new to report on the broad market other than the fact that SPY found support at this recently highlighted uptrend line yesterday. A new (yellow) potential downtrend line has been added to this 60-minute chart. Bottom line is that the broad market remains locked in 2.8 month tight sideways trading range while the price & momentum indicators on the 60-minute time frame have all but flattened out, providing little to no clues on the next direction in the market, although the longer-term charts continue to indicate that the next major trend will likely be to the downside.

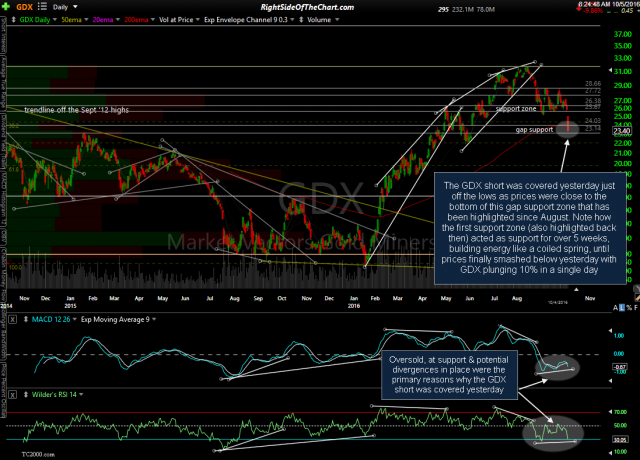

The GDX short was covered yesterday just off the lows as prices were close to the bottom of this gap support zone that has been highlighted since August. Note how the first support zone (also highlighted back then) acted as support for over 5 weeks, building energy like a coiled spring, until prices finally smashed below yesterday with GDX plunging 10% in a single day. Oversold, at support & potential divergences in place were the primary reasons why the GDX short was covered yesterday. The first chart below was posted back on Aug 24th highlighting those support levels with the second chart below showing the price action since then through yesterday’s close.

- GDX daily Aug 24th close

- GDX daily Oct 4th close

As impressive as yesterday’s 10% drop & 27% correction off the mid-August top in GDX was, the most impressive sector lately has been the cannabis/marijuana stocks. I believe it would be accurate to say that every trade idea highlighted in most or all of the recent cannabis stock trade ideas video & via trading room posts has moved up sharply with many of those stocks up in the high double digits & even quite a few posting percentage gains well into the triple digits (100%+). While the momentum is very clearly still in the sector, I have been gradually reducing exposure over the last week & while I will most likely keep small core positions in many of those companies, I plan to continue to strategically reduce exposure (i.e.- closing partial or full positions as any of the highlighted price targets are hit or even on overshoots of some of those targets) with the intention to watching those stocks & the sector for the next objective re-entry point(s). From my experience, you don’t want to be the last guy (or gal) to leave the party once the momentum player decide to exit as these stocks can fall as fast as they rise once the tide has turned.

I plan to spend some time today updating the trade ideas listed on the site by removing any trades that have either hit their final price target, exceeded their suggested stop or simply no longer look compelling from an R/R perspective. Post notifications will only be sent out by email on any time sensitive trade update or if any changes (price targets, stops levels, etc..) are made to any of the Active Trades or Trade Setups. Once the trade categories are updated I will begin to post some new trade setups that I’m watching, in which post notifications will be sent out via email.