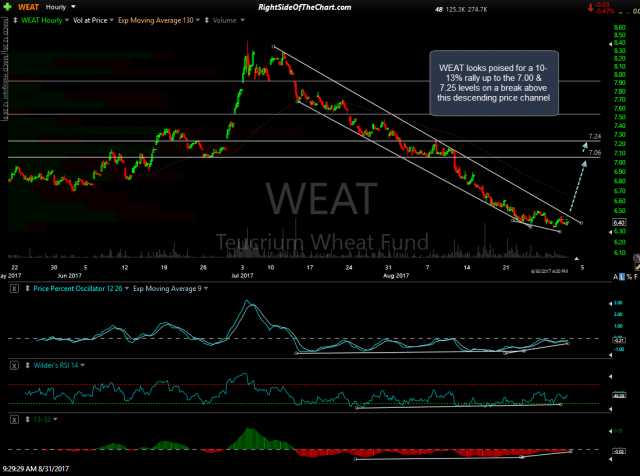

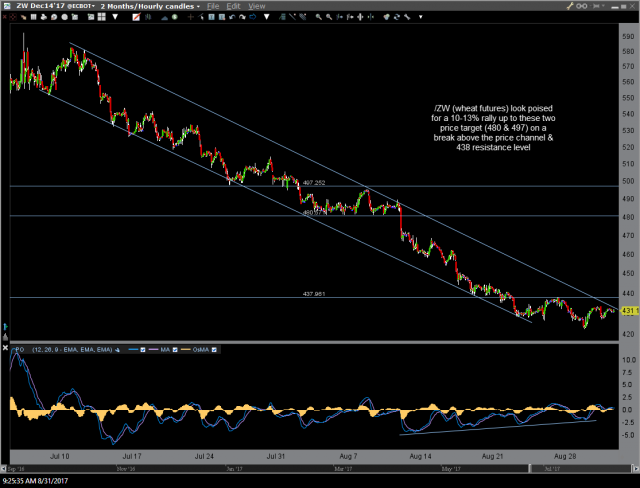

The WEAT (Wheat ETN) active long swing trade continued to evade the suggested stop by the skin of its teeth, closing just a penny above the suggested stop of any close below 1.40 (i.e.- a close of 1.39 or lower). The stock has flirted with that stop for over a week now but the charts have continue to firm up. Both WEAT & /ZW (wheat futures) look poised to rally 10-13% on a break above their respective descending price channels (60-minute charts).

- WEAT daily Aug 31st

- ZW 60-min Aug 31st

The case for a lasting bottom in wheat prices can still be made when viewing this 20-year weekly chart of $WHEAT (continuous futures contract), with prices sitting just above dual long-term support levels (price & trendline) following the recent divergent low. I just wanted to reiterate that the R/R remains favorable on this trade despite the lack-luster performance since the entry on August 18th.