WEAT (Wheat ETN) appears to be in the process of a flush-out, stop-clearing move below the previous lows while deeply oversold. While certainly a “catch-a-falling-knife” trade, I believe that the R/R for a long entry here with a stop somewhat below offers a very favorable R/R. As such, WEAT will be added as an Active Long Swing Trade as well as a Long-term Trade idea as I will likely add additional price targets, should the charts of WEAT, $WHEAT (continuous futures contract) and /ZW (wheat futures) exhibit bullish price action in the coming weeks that may indicate a likely bottom in wheat prices.

- WEAT daily Aug 18th

- WEAT 60-min Aug 18th

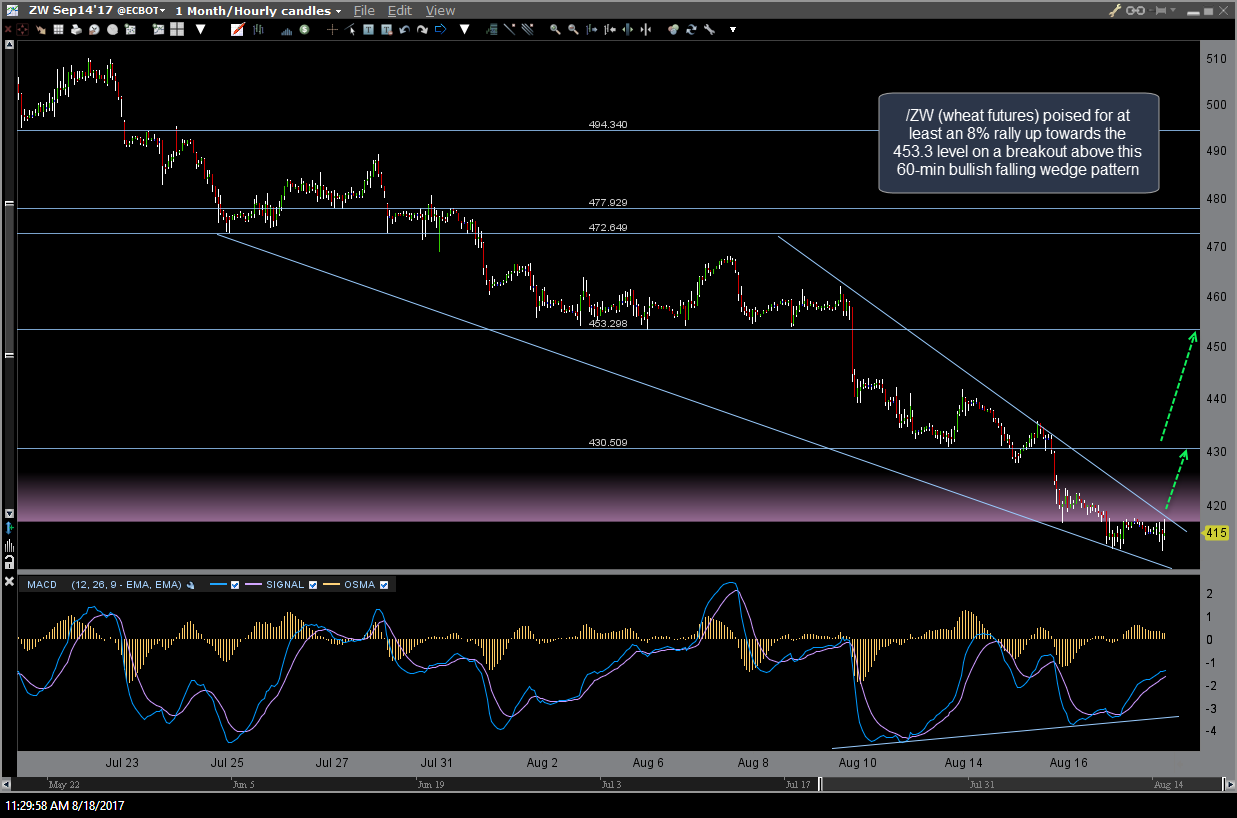

The bullish falling wedge on this /ZW (wheat futures) 60-minute chart indicates that that wheat futures are likely poised for at least an 8% rally up towards the 453.3 level on a breakout above this 60-min bullish falling wedge pattern. Those adverse to trying to catch a falling knife could wait for a 60-minute breakout & candlestick close above this falling wedge pattern as that would increase the odds of this trade panning out.

WEAT will be added here as an Active Long Swing Trade as well as an Active Long-term Trade with a suggested stop on a daily close below 6.40, about 2½% below current levels. The price targets at this time are T1 at 6.92 & T2 at 7.18. The suggested beta-adjustment at this time is 0.9 although I might consider increasing that to as much as 1.2, should we get some decent evidence of a bottoming process in the coming days or weeks.