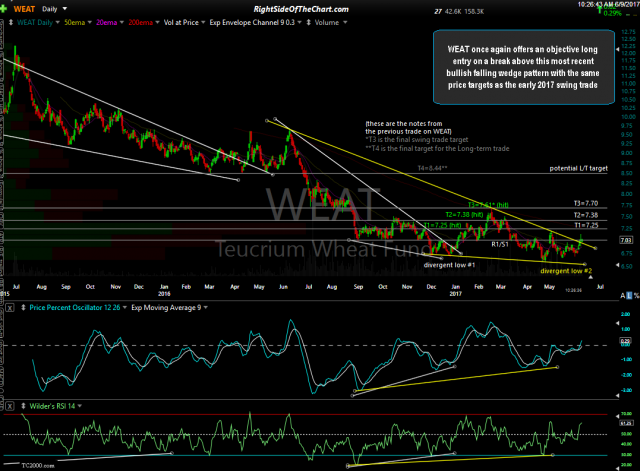

Since Tuesday’s Agricultural Commodities Continuing To Firm Up post, the charts on all of those ag commodities have built on the recent gains & as such, I will be adding some or all of those highlighted commodities, starting with WEAT (Wheat ETN) as official trade ideas. WEAT once again offers an objective long entry on a break above this most recent bullish falling wedge pattern with the same price targets as the early 2017 swing trade. That trade entered back on January 3rd was also based on a breakout above a bullish falling wedge pattern, albeit a considerable smaller wedge (white) than the one that WEAT has just broken above (yellow).

- WEAT daily Jan 3rd

- WEAT daily June 9th

- $WHEAT 10-yr daily Jan 2nd

- $WHEAT daily June 9th

The price targets for this trade will be the same as that earlier trade as those are still significant resistance levels where a reaction is likely (as always, my price targets are set slightly below the actual resistance level). The suggest stop for this trade will be any move below 6.80 with a suggested beta-adjustment of 1.2, which is 20% above a typical position size as the daily price swing on wheat is relatively low.