WBA (Walgreens Boots Alliance Inc.) looks ripe for a break below this H&S topping pattern as well as the bottom of the horizontal support zone along with a likely break & weekly close below it’s primary bull market uptrend line (see weekly chart). WBA will trigger an short entry on a break below 81.10 with a suggest stop over 83.40.

- WBA daily Nov 11th

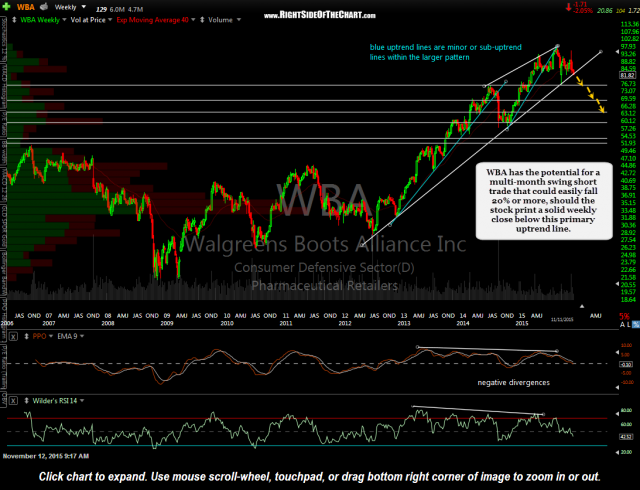

- WBA weekly Nov 11th