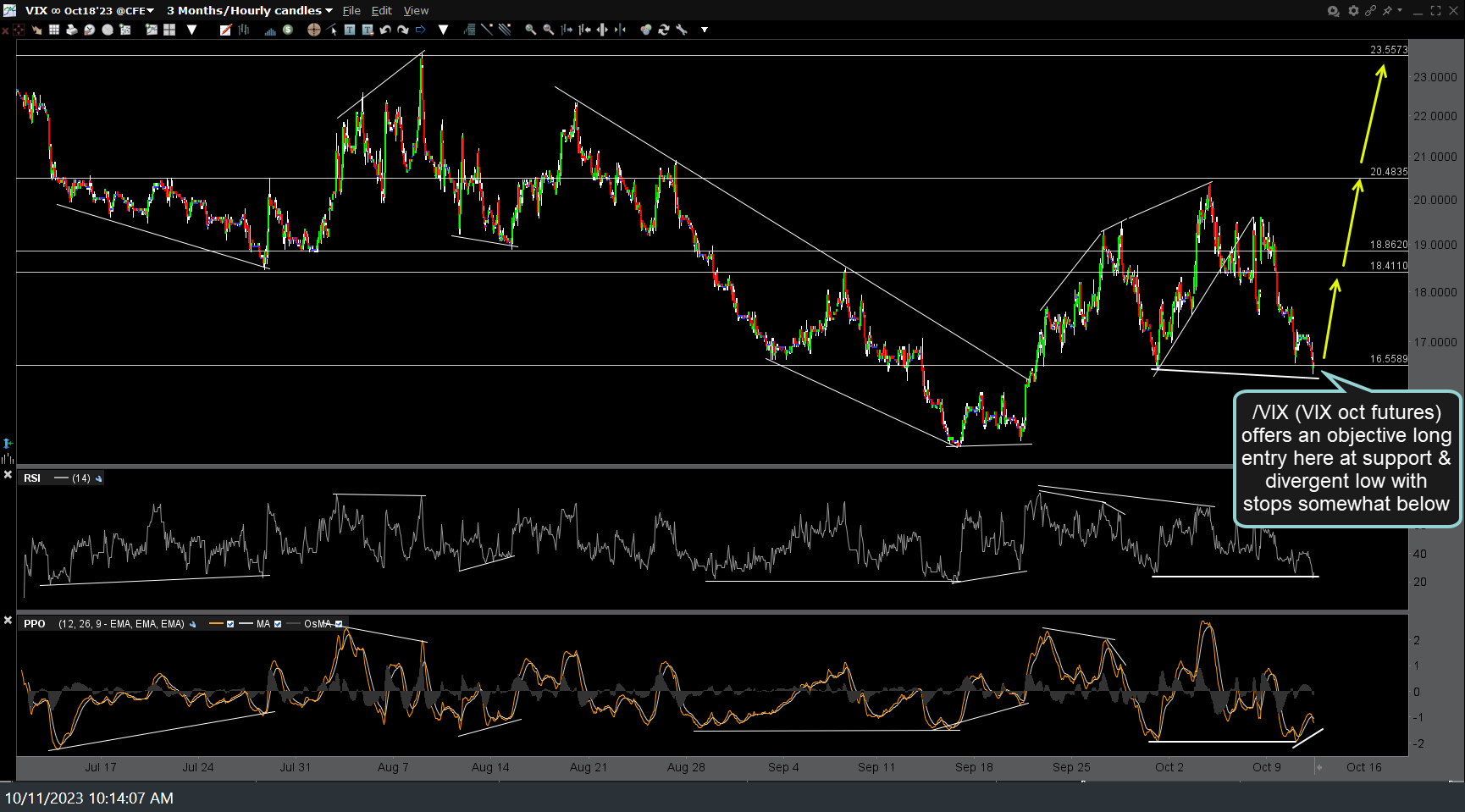

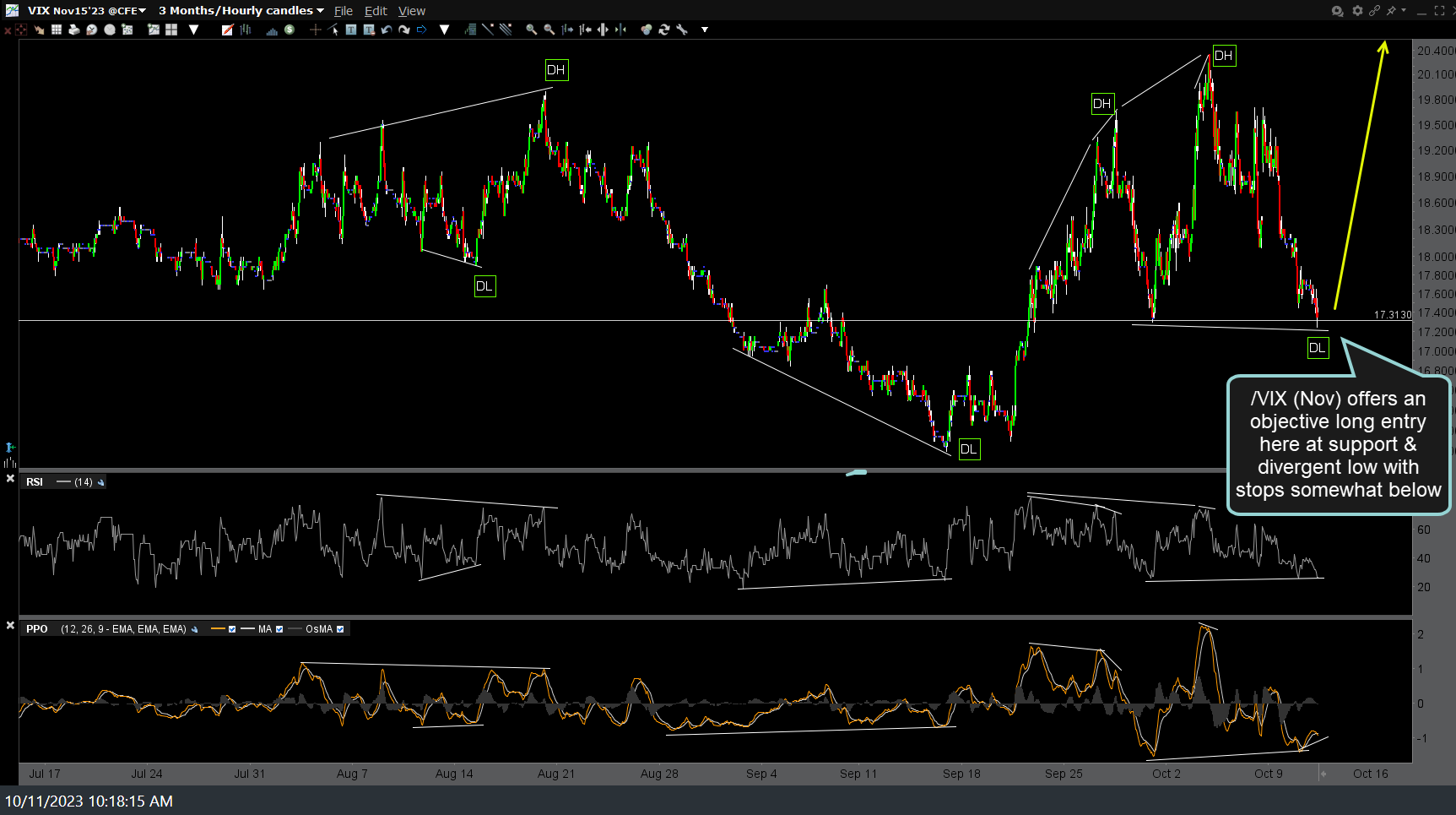

/VIX ($VIX volatility index futures) offers an objective long entry on this pullback to support & divergent low with stops somewhat below. 60-minute charts of both the October & November contracts below.

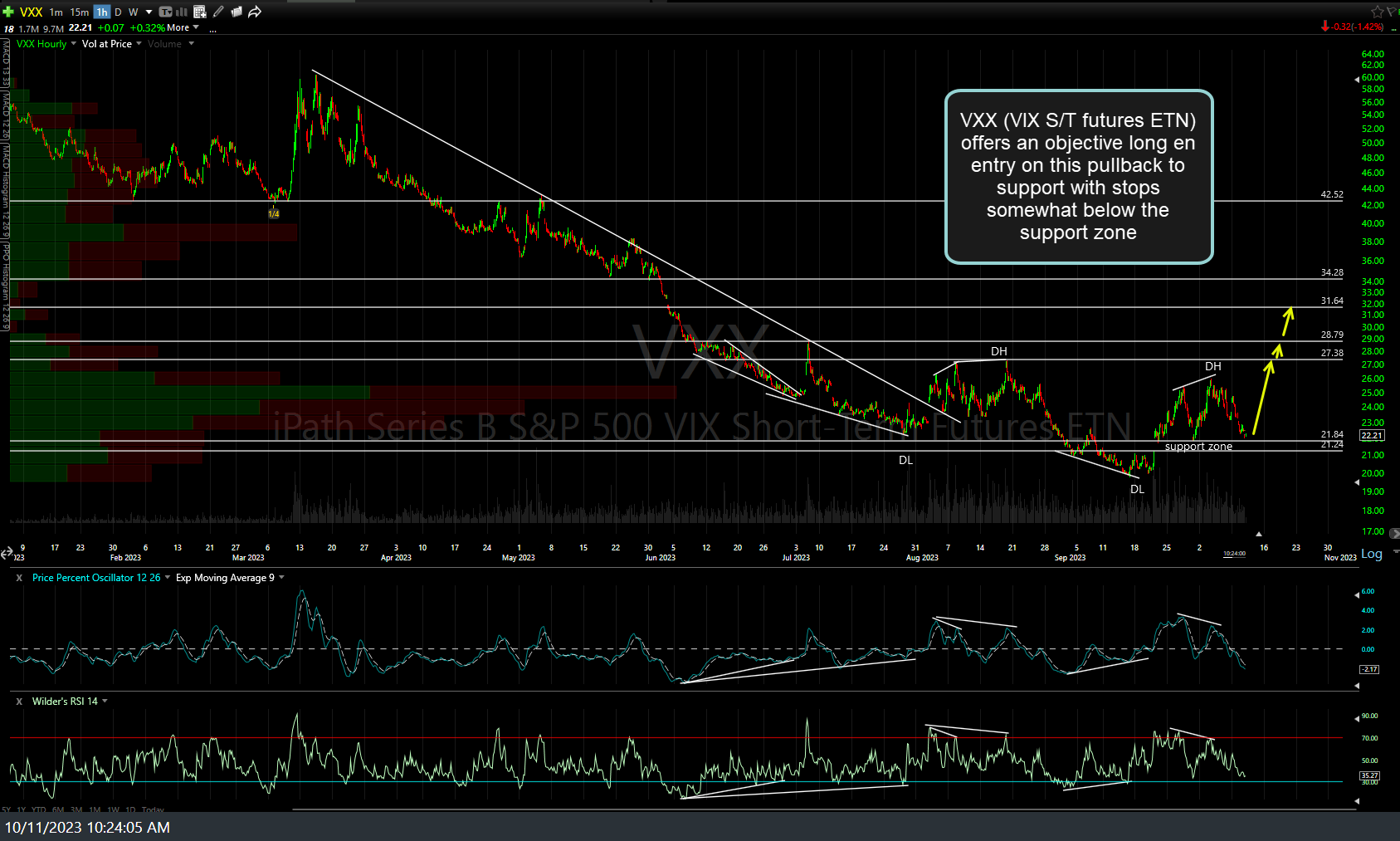

For those that prefer ETP (exchange traded products) over futures, VXX (VIX S/T futures ETN) also offers an objective long en entry on this pullback to support with stops somewhat below the support zone. 60-minute chart below.

A few considerations on this trade. First & most importantly, keep in mind that trading any of the VIX derivatives (i.e.- futures, options on the futures, or VIX tracking ETNs) is one of the most aggressive trades that exist in the financial markets. Not only are the extreme price swings some of the largest on any publicly traded security, but a long or bullish bet on the $VIX is essentially a bearish or short bet on the stock market.

As the stock market goes up much more than it falls, just like short-selling, one must have much more precise timing than long-side traders. Therefore, pass on this trade idea if it doesn’t mesh with your trading style, risk-tolerance, skill sets, & of course, outlook for the stock market. Should you decide to take a position in any of the $VIX tracking instruments, be sure to make the proper downward beta-adjustment to your position size to account for the above-average gain & loss potential.