VIXY (VIX short-term futures ETN) offers an objective long entry on this pullback to minor support with the next buy signal/add-on to come on a solid break above 47.83. Price targets denoted at the arrow breaks & a suggested stop commensurate with one’s preferred price target(s). Also, note that additional targets will likely be added if NVDA clearly takes out the primary uptrend line off the Oct ’22 lows following their earning report after the market close on Wednesday. 60-minute chart below.

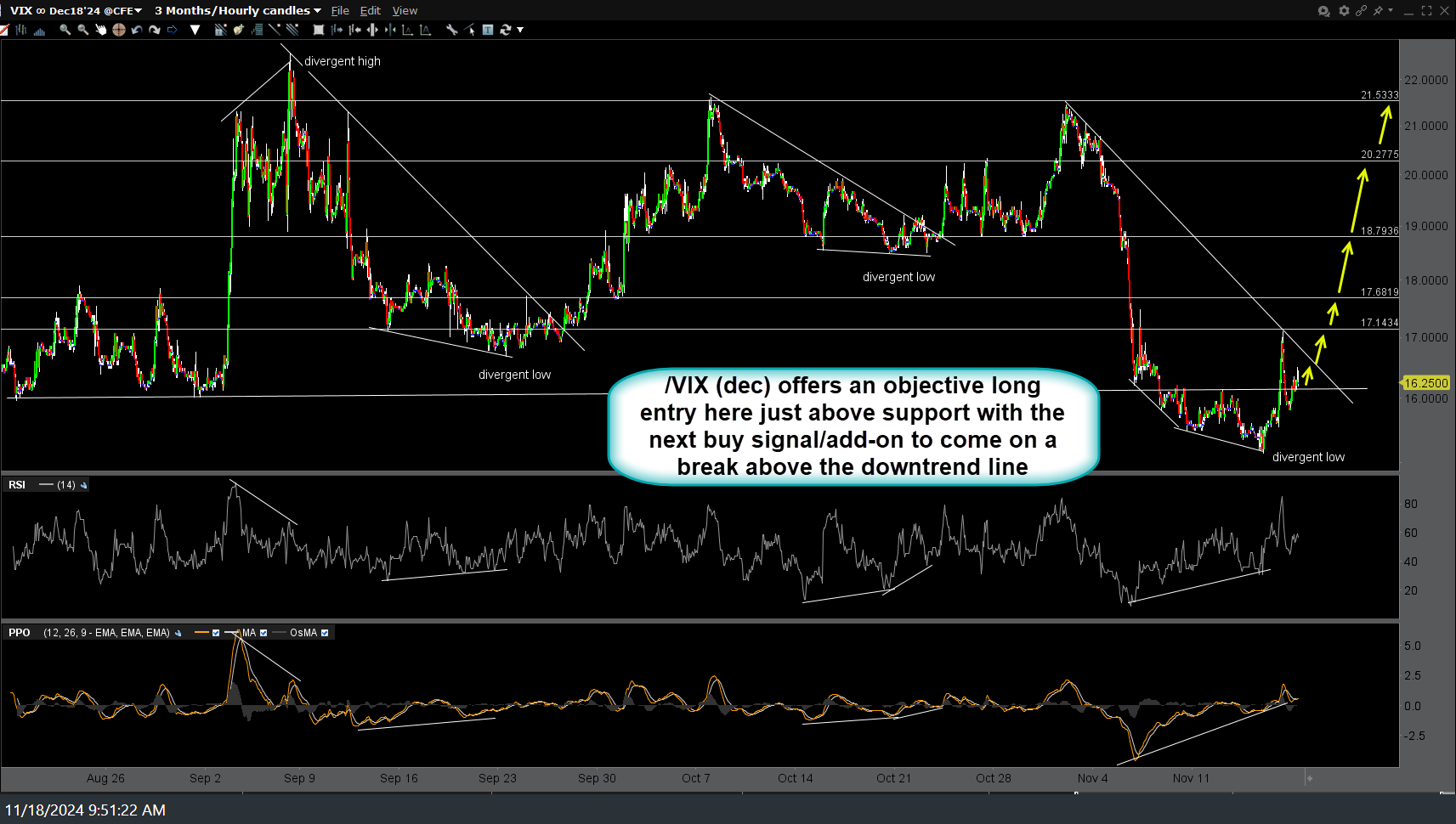

Alternatively, /VIX (Dec $VIX futures contract) offers an objective long entry here just above support with the next buy signal/add-on to come on a break above the downtrend line. My preference is to only take a starter (fractional) position here, adding if & when the two aforementioned criteria (VIXY/VIX resistance breakout & NVDA primary trend line break post-earnings) are triggered. 60-minute chart below.