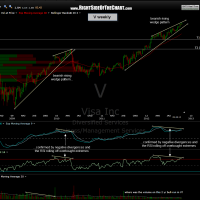

As a follow-up to the MA post below, here’s the update on the V active short trade/setup. If you recall from the original post, I mentioned V as a possible short entry at the top of the wedge (which has been slightly re-drawn) back on Oct 19 as an “anticipatory” trade for aggressive traders, suggesting only shorting a half position but advising conventional traders to wait for a breakdown of the rising wedge pattern before entering a short position.

Since then, V has continued to climb with the wedge, failing to trigger an entry from a pattern breakdown but similar to MA, V might be in the process of a wedge overthrow, whereby prices shoot above the pattern and quickly reverse back down into and ultimately below the pattern. If so, that would trigger a sell signal/short entry on V. Like MA, I believe that this trade has the potential to be a very lucrative swing short in 2013 and is most likely in the final stages of it’s bull market uptrend. Previous and updated daily & weekly charts below: