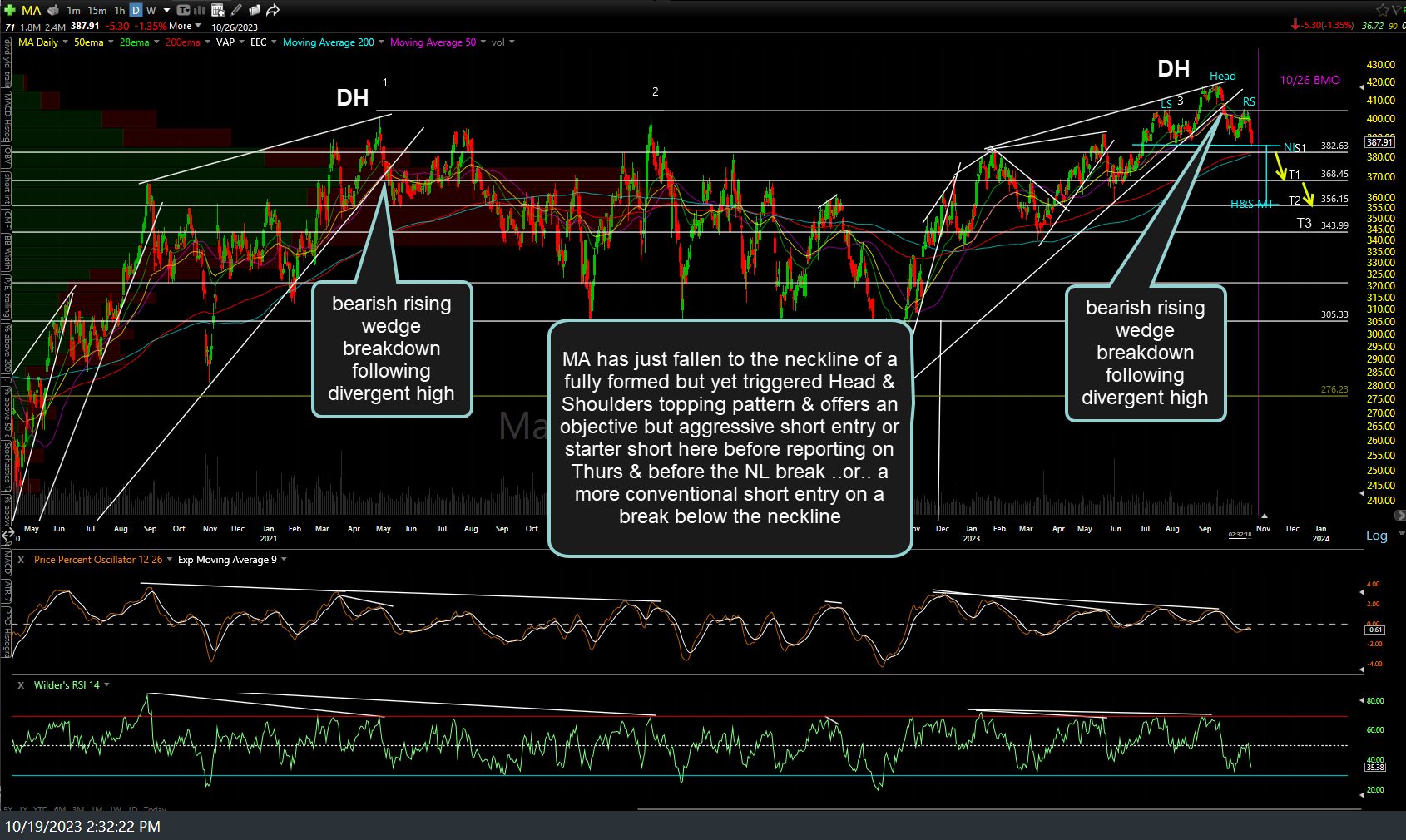

Oh, so much to like in these charts for a short seller. MA (MasterCard Inc.) has just fallen to the neckline of a fully formed but yet to be triggered Head & Shoulders topping pattern & offers an objective but aggressive* short entry or starter short here before reporting on Thursday & before a break below the neckline ..or.. a more conventional short entry on a break below the neckline. Also worth nothing is the fact that MA just recent put in a divergent high followed by a failure of the recent breakout above key resistance & a new all-time high (i.e.- bull trap) and then went on break break down below a large bearish rising wedge pattern nearly identical to the one it broke down below back in May of 2021 (which was followed by a 25% drop over the following 1.4 yrs). Daily chart below.

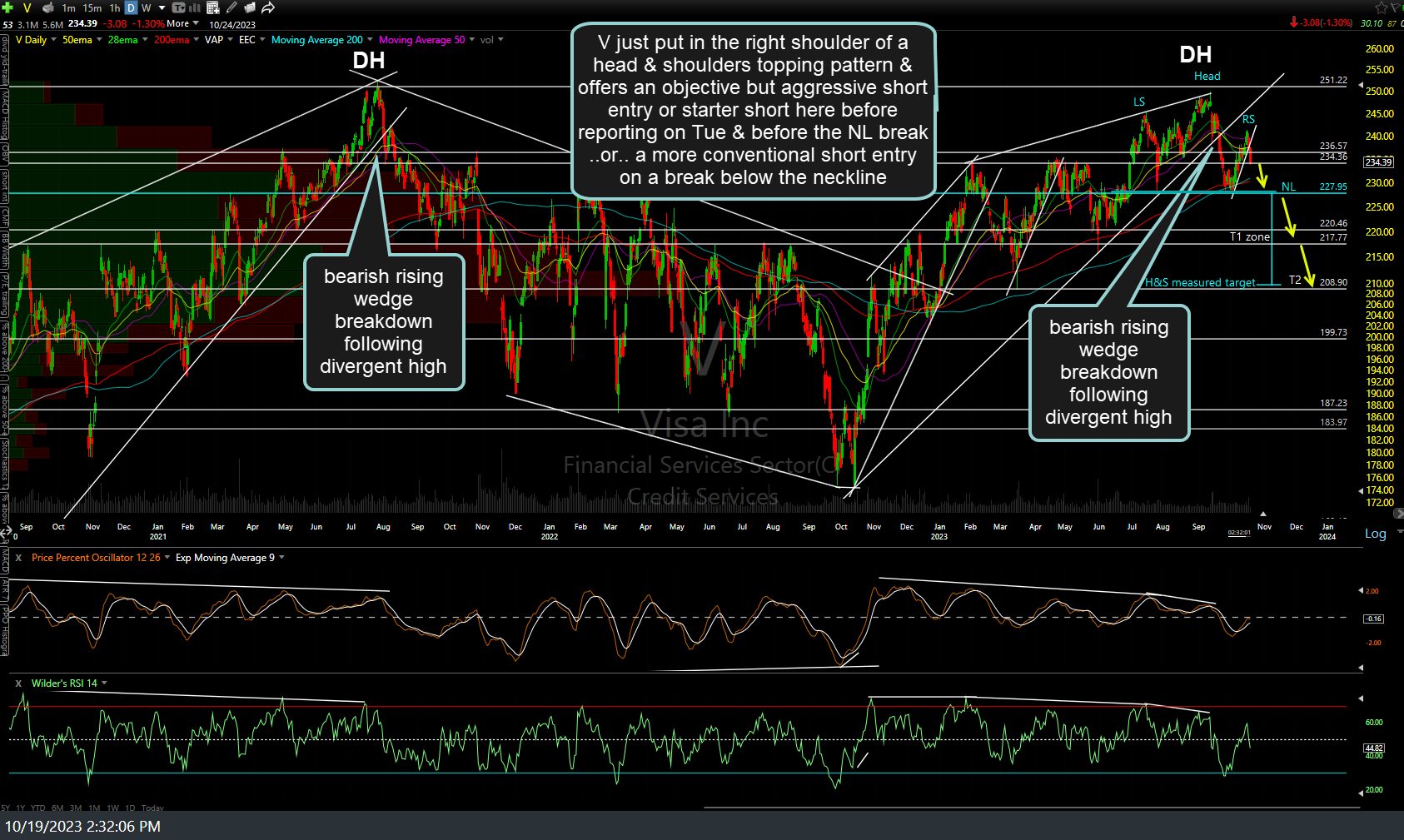

Birds of a feather… V (Visa Inc) just put in the right shoulder of a head & shoulders topping pattern & offers an objective but aggressive* short entry or starter short here before reporting next Tuesday & before the neckline break ..or.. a more conventional short entry on a break below the neckline. As with MA, V also recent put in a major (double-top) divergent high followed by a breakdown below a large bearish rising wedge pattern nearly identical to the previous one it broke down below back in Aug 2021 with the stock plunging 27% over the next 13 months from that breakdown level.

* I consider a short entry here (which is my preference) aggressive for two reasons:

1) A Head & Shoulders pattern is a potentially bearish technical pattern which, once fully formed, has an entry trigger (sell short) if & when the price drops down below the neckline. Hence, shorting a bearish technical pattern without a sell signal in anticipation that it most likely will go on to break down is aggressive.

2) Entering any swing trade position just before earnings is also aggressive as stocks often make large moves (via opening gaps up or down) following earnings & any post-earnings move can go either way. However, it has been my experience that stock with a clearly bullish or bearish (in this case) technical posture heading into earnings will more often determine the ultimate direction (regardless of any initial post-earnings knee-jerk reaction) a stock will head following earnings.

As such, my preference (as an aggressive trader) is to establish a partial short position here, adding to that position following earnings, depending on how the stock is trading & if an objective add-on opportunity presents itself at the time. I suspect, especially if the stock market continues lower next week, that MA & V may gap down below their respective necklines following earnings.

Visa is scheduled to report next Tuesday after the market close while MasterCard is scheduled to report next Thursday before the market opens.