The recent annihilation of DG (Dollar General) & DLTR (Dollar Tree) made the demise of the low-end consumer crystal clear to those that hadn’t already seen the mounting evidence while the death of the major credit card companies (should this prove to be the start of that) will help put in the nail in the coffin for the middle class consumer & hence, the economy at large (with consumer spending accounting for around 2/3rds of GDP).

Regardless, V (Visa), MA (MasterCard), & AXP (American Express) all offer objective short entries on these breakdowns below their most recent uptrend lines. Price targets & suggested stops are listed on each chart below. Shorting all three is a way to diversify among the big 3, with no way of know which will outperform to the downside (or possibly be stopped out). The suggested beta-adjusted position size for either any single one, or all three as a basket trade, is 1.0 (i.e.- around the same as one would put into a trade on SPY.

For those currently short or planning to short or add to an XLF short, keep in mind that these big three credit card companies are top components of XLF & as such, one should account for that overlap in their position sizing.

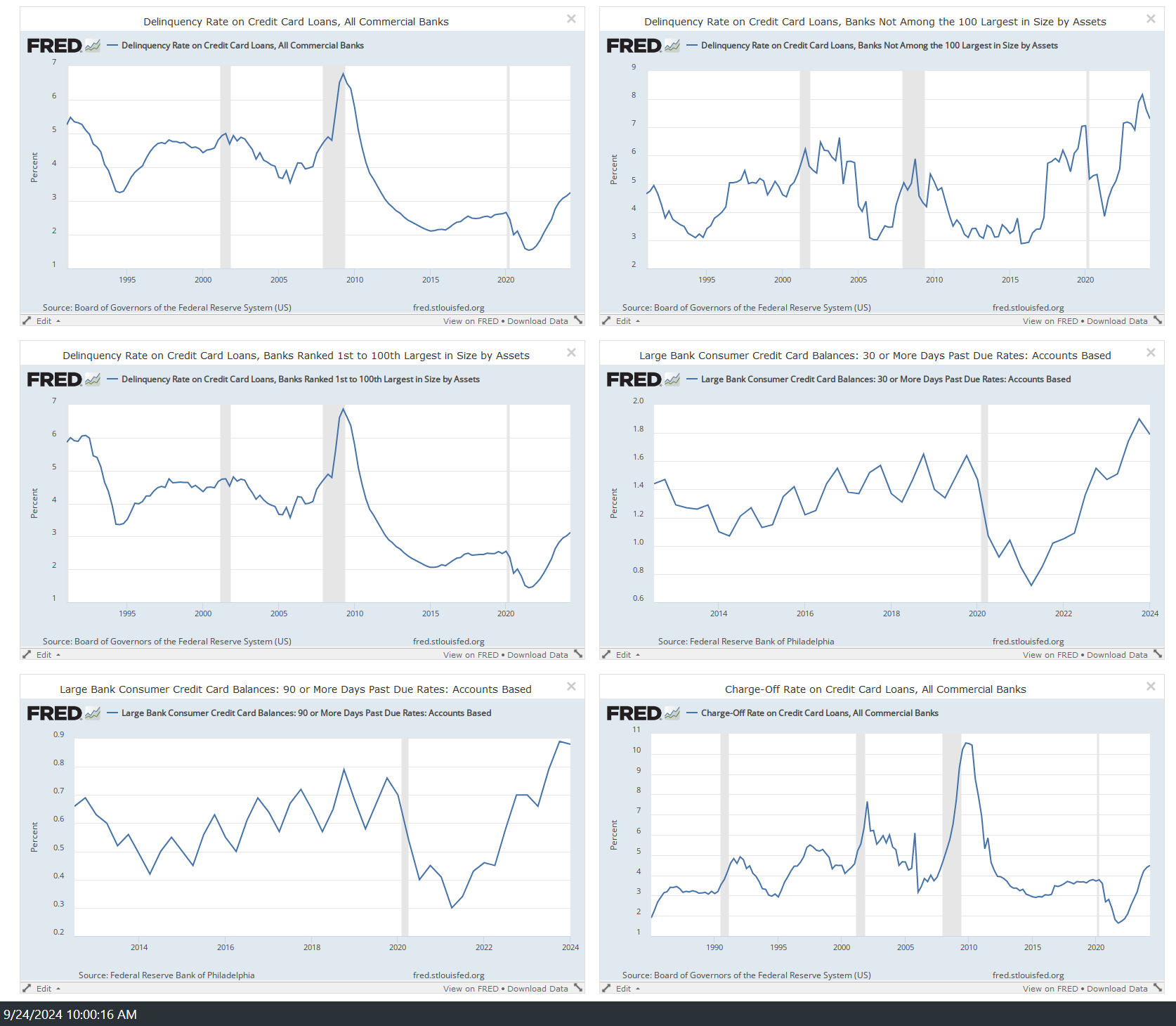

For reference, here is a mosaic of some of the charts (via the Federal Reverse Bank of St Louis’ website) that I recently highlighted in last week’s video showing the clear & accelerating deterioration in consumer debt (delinquencies & charges offs).