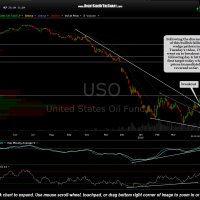

The first chart below is a screenshot from Tuesday’s video in which I highlighted this horizontal line as the target for the impending breakout of USO (which occurred yesterday). As with the initial tag of each target, a pullback and/or consolidation is likely. The second chart is today’s update chart of USO highlighting the breakout, which was mentioned yesterday, along with the tag of that target/resistance level today.

- USO screenshot from April 14th video

- USO daily April 16th

The fact that USO has hit a key resistance level while very overbought in the near-term along with several other energy stocks, such as PWE, also hitting resistance, sharply increases the odds for a tradeable pullback in the energy sector at this time.

note: Parameters for a PWE pullback/reversal trade (long to short) were posted on the Twitter feed shortly after the last update on PWE for those interested. That is an “unofficial” trade, meaning that it will not be added as an Active Trade Idea on the site as a typical swing trade. Shorting an stock in an extremely strong uptrend is an aggressive trade, intended as a very quick, counter-trend trade that is likely to be completed (successfully or not) within just a few trading sessions. Always trade according to your own abilities, objectives and risk tolerance.