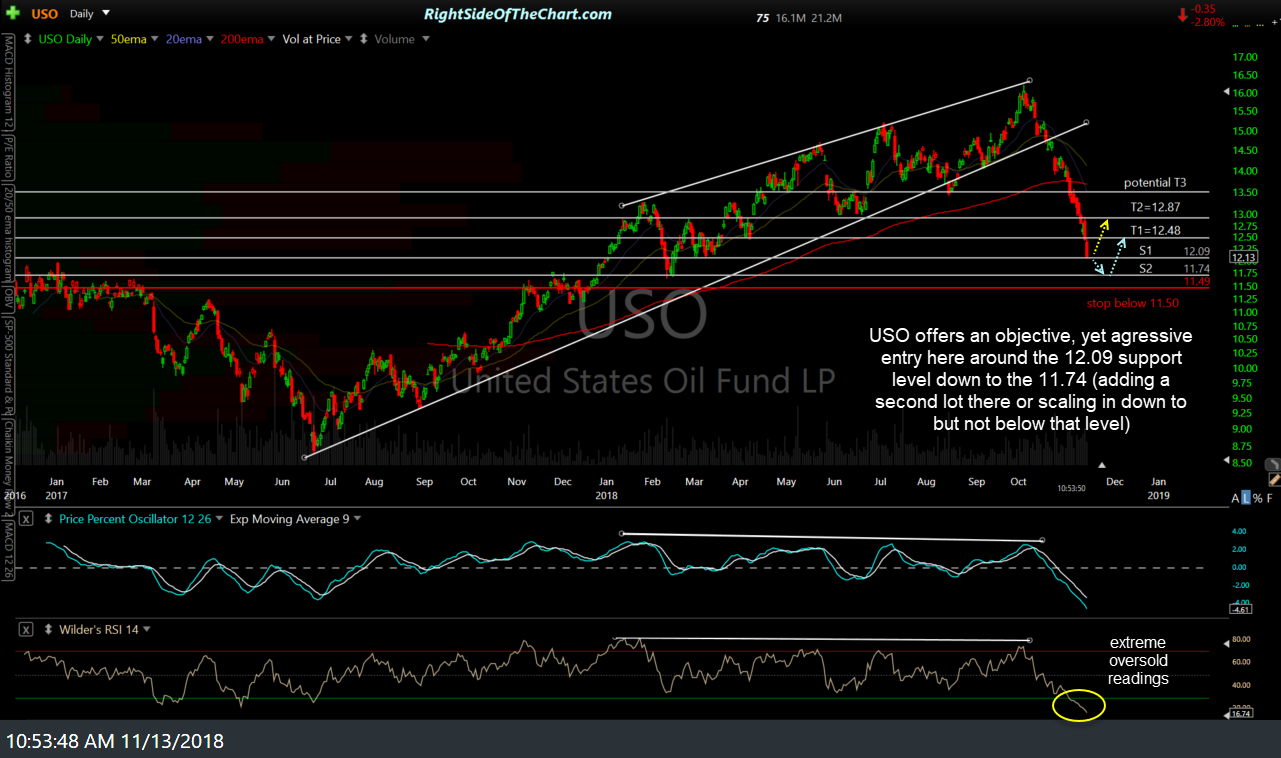

USO offers an objective, yet aggressive entry here around the 12.09 support level down to the 11.74. For tracking purposes, the official entry will be at the current price of 12.13. One option would be to take a full position here with an alternative and somewhat more conservative strategy of either taking half of a position here & adding the second half, or scaling in down to but not below the 11.74 support level.

The price targets for this trade are T1 at 12.48 and T2 at 12.87 with the potential for a third target to be added around the 13.50 level, depending on how the charts develop going forward. The maximum suggested stop is any move below 11.50, although one should consider a stop commensurate with their average cost, if scaling in. The suggested beta-adjusted position size for this trade is 1.0.

One of the primary reasons for taking an aggressive, counter-trend trade “catch a falling knife” without any buy signals or evidence of a trend reversal is the fact that /CL (crude futures contract) has fallen to the top of a significant resistance zone which was & still is my minimum initial price target from back in early October just before crude peaked. Additionally, USO has fallen to a major support zone after reversing off long-term support.

Note: The website is in the process of being migrated to an upgraded sever today, which was the cause of the recent outage. This process is expected to be completed today & may or may not cause an further issues with accessing the site.

The screenshots on the charts above were taken just before the site went offline earlier today but USO is still trading around the same levels as crude has been trading mostly flat since then. Thank you for your patience with this issue.