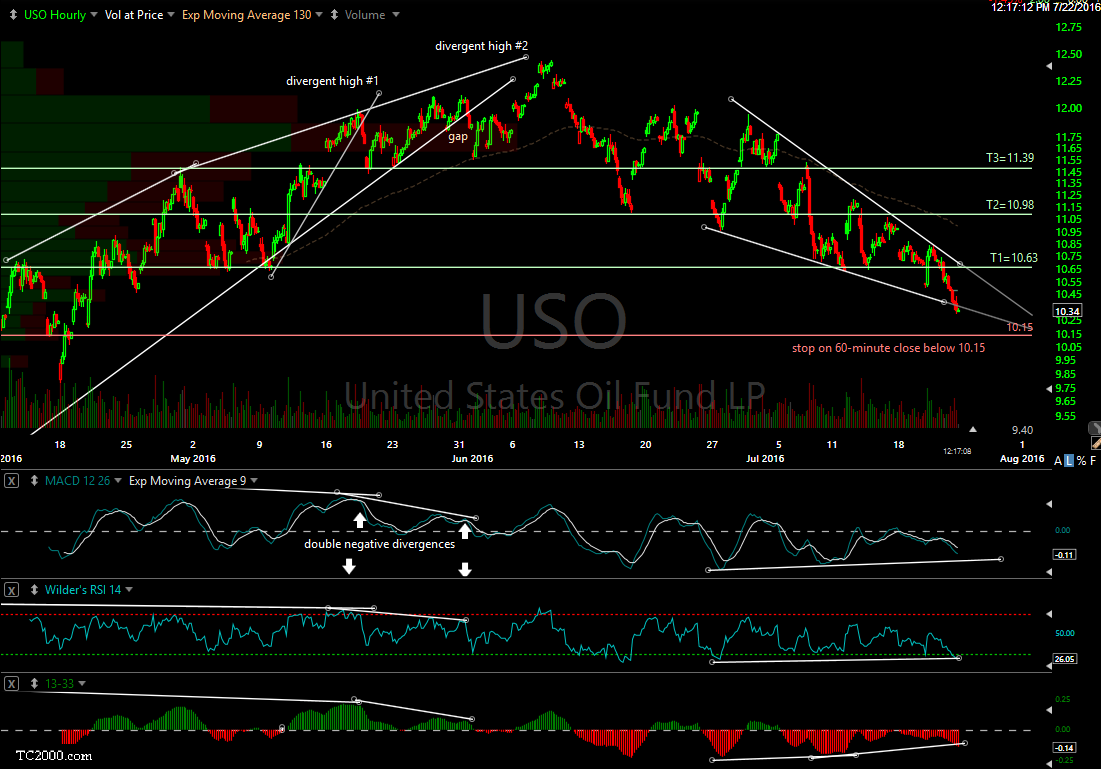

The price targets for the recently posted USO long/DWTI short trade will be T1 at 10.63 (for those only looking for a quick bounce trade), T2 at 10.98 and the current final target of T3 at 11.39. The suggested stop for those targeting T2 or T3 will be on a 60-minute candlestick close below 10.15. Once again, the entry posted earlier today is an aggressive entry with a more conventional, higher probability entry to come on either decent evidence of a reversal before the 10.15 level and/or a breakout above the top of the wedge pattern.

USO DWTI Price Targets & Suggested Stop-loss

Share this! (member restricted content requires registration)

20 Comments