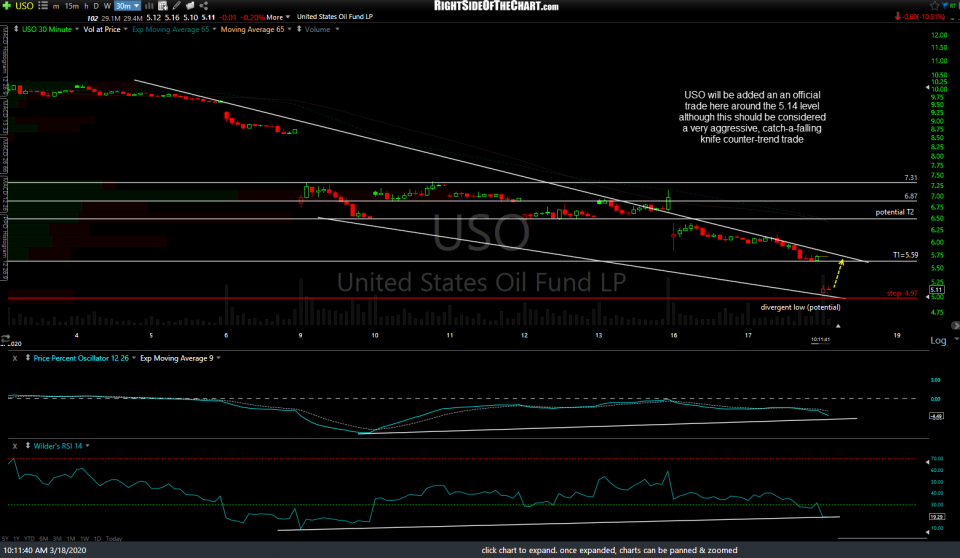

USO (crude oil ETN) will be added an official trade here around the 5.14 level although this should be considered a very aggressive, catch-a-falling knife counter-trend trade. The sole price target at this time is T1 at 5.59 with the potential for a second price target to be added around the 6.45ish resistance level, depending on how the charts develop going forward.

I’m keeping stops relatively tight on this one with a suggested stop of 4.97. The suggested-beta adjusted position size on this trade is 0.60 due to the volatile nature of crude prices coupled with the fact that this trade is also a gamble on the expectations that crude will rally on the weekly inventory report due out at 10:30 am EST today. As such, those interested in this trade but wanting to notch the risk down a bit on an already very aggressive trade might opt to wait until the inventory report is out of the way. Once again, pass if this very aggressive trade does not mesh with your risk-tolerance, trading style or outlook for crude oil. 30-minute chart above.