/CL (crude oil futures) broke down below the 60-minute uptrend line support just like /NQ & /ES (stock index futures) and like the stock indexes, has been dancing on minor support. Next sell signal to come on an impulsive break and/or 60-min close below 62.00.

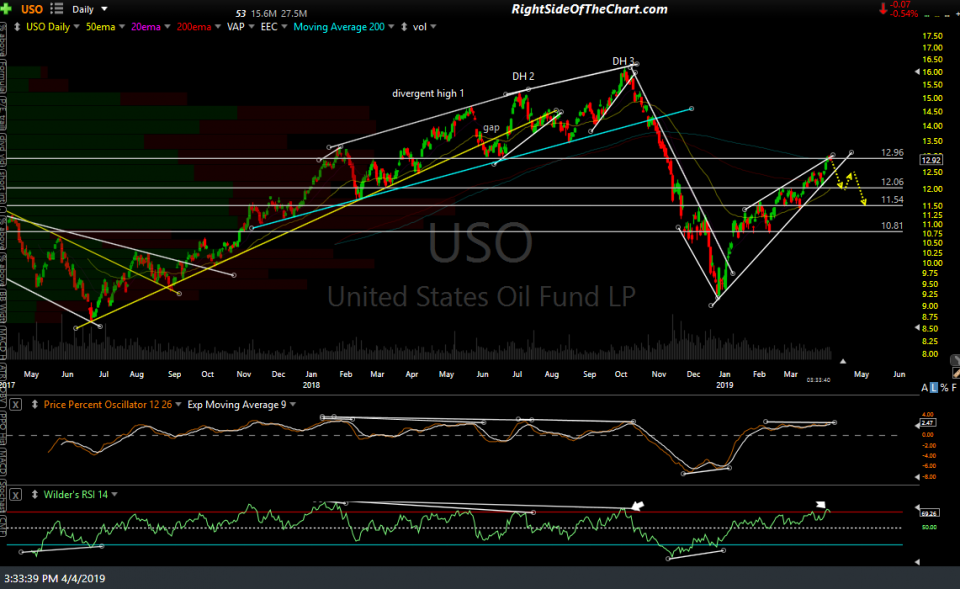

Likewise, USO (crude oil ETN) continues to stall at the 13.00ish long-term resistance level & top of its bearish rising wedge pattern with the RSI at overbought levels that has lead to corrections in the past. USO or DWT is still under consideration for an active trade and I can say that official or unofficial, USO looks to offers an objective short entry on a solid break & close below that 62 level on CL (or below 12.85 on USO) although as a counter-trend trade, it would be an aggressive entry without a solid sell signal on the daily time frame. That could come on a bearish candlestick reversal pattern and/or an impulsive break below the rising wedge pattern/uptrend line.

On final consideration prompting me to hold off from adding crude as an official trade as this time is the strong positive correlation to the broad market & the fact that the S&P 500 remains above the 282ish support level for now while continuing to hold up in spite of the overbought conditions, divergence & recent 60-minute trendline breaks. I’m going to add this as a Short Swing Trade Setup for now, with an official entry and price target TBD although the 12 area on USO would be my minimum downside target, should we get a sell signal soon.