Member @erikthered requested an update on /CL (crude oil futures) in the trading room so I figured that I’d post the charts of both /CL & USO (crude oil ETN) for those interested. However, I will say that my read on the near-term direction of crude isn’t very strong right now although there are some levels & developments worth noting.

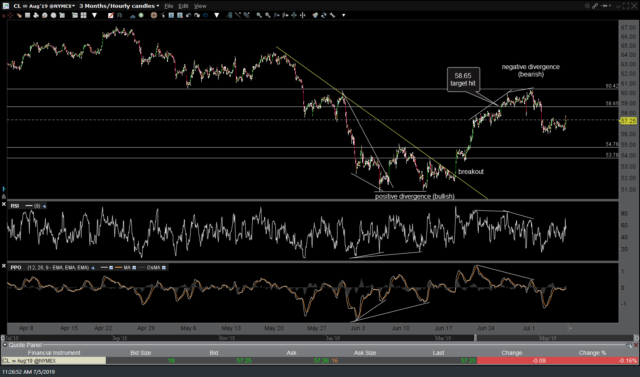

I’ve attached a string of the previous 60-minute charts of /CL that were posted on the site following the previous divergent low & trade setup for /CL with a long entry to be triggered on a break above the yellow downtrend line. /CL was very “tradable” following that breakout, offering both a very profitable long-side swing trade as well as several “micro-trend” trades off of those targets, both long & short. (click on the first chart to expand, then click on the right of each chart to advance)

- CL 60-min June 17th

- CL 60-min June 18th

- CL 60-min June 19th

- CL 60-min 2 June 19th

- CL 60-min June 20th

- CL 60-min July 5th

While I was on vacation, /CL went on to hit my final swing target of 58.65 for a gain of more that 12% from the trendline breakout/long entry point while putting in a divergent high, followed by the typical correction shortly afterward. As of now, /CL is in what I refer to as no man’s land, smack between decent support (54.76) and resistance (60.42) and as such, I prefer to stand aside to let the charts develop while patiently await the next objective & high-probability entry.

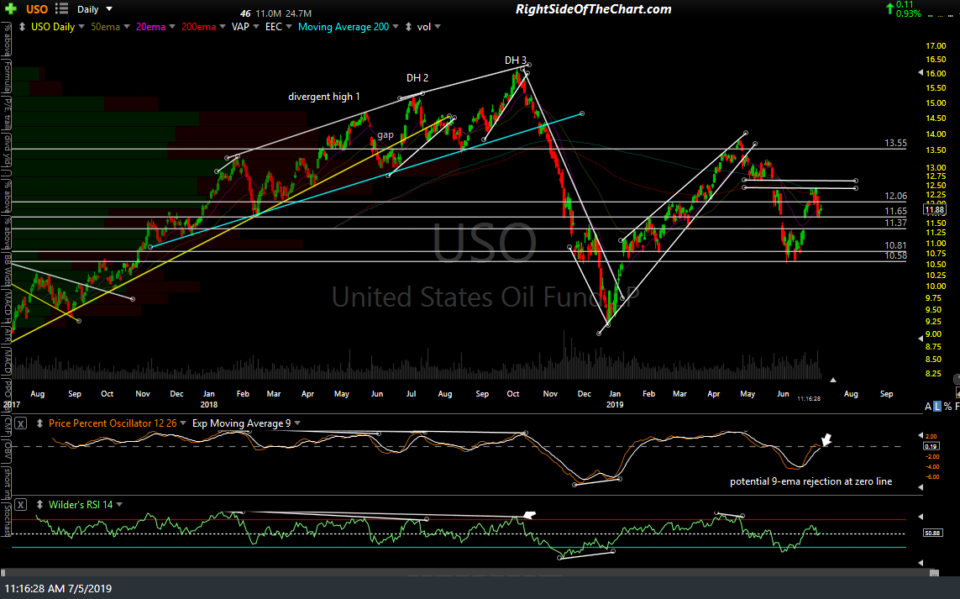

On the USO daily chart above, the crude ETN is currently trading just above the 11.65 gap support level. Should USO enter the gap from above (i.e.- a break below 11.65) the odds would favor a backfill of the gap & if so, that might provide an objective long entry for at least a quick bounce trade off the 11.37ish support (bottom of the gap + additional price support).