Just to clarify or expand on the previous 60 minute QQQ chart & comments, we did get a 60 minute close below the recent lows in the Q’s but by the slightest margin. Much more importantly, the three broad US indices that I focus my analysis on; the $SPX, $NDX, & $RUT are all still sitting essentially on or above key support (my long-standing first downside targets on the daily charts). Of course support is support until broken and although I still favor prices ultimately breaking below these support levels, at this time I continue to favor a bounce off the initial tag of these levels. As I’ve also repeatedly stated over the last several trading sessions, my degree of confidence on the near-term directions of the markets (and hence, any possible bounce) is not very strong and so my preference remains to keep things light by hedging up close to a market neutral portfolio (taking some long exposure to offset a large number of swing short trades that have yet to hit my preferred targets).

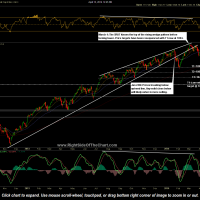

The daily charts of the $NDX, $SPX & $RUT below show the $NDX basically still trading at my first target level with both the $SPX & $RUT still slightly above their respective first downside targets, which are likely to be tagged before any meaningful bounce. If that happens, the $NDX would likely go slightly lower & thereby overshooting this support level by a relatively small margin. Only a solid break below these target/support levels on all three indices would convince me to remove my long hedges as that would likely open the door to a move down to the next target levels. As always, the live links to these charts are accessible from both the sidebar on the Homepage as well as the Live Chart Links page.

- $NDX daily April 15th

- $SPX daily April 15th

- $RUT daily April 15th