So far, so good on the $USD reversal call. However, the Fed announce due out shortly will likely either thrust the EUR/USD to this swing bounce target (my expectation) or bust up the near-term bullish technical posture of this currency pair.

As I received several requests for my comparable price target on the FXE (Euro ETF), I’ve gone ahead and included the daily & 60 minute charts of FXE , including some shorter-term bounce targets in addition to the current swing target, as well as the daily chart of FXY (Yen ETF) and YCS (Ultrashort Yen).

I often talk about how leveraged ETF are best used for very short-term trades due to the inherent price decay but that decay can also be used to one’s advantage by shorting a 2x or 3x leveraged ETF that is positioned opposite in the direction of your desired trade (e.g.- instead of going long $10k of FXY for a trade expected to last several weeks or months, you could short $5k of YCS.

- EUR-USD daily March 18th

- EUR-USD 60 minute March 18th

- FXE 60 minute March 18th

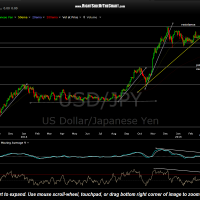

- USD-JPY March 18th

- FXY daily March 18th

- YCS daily March 18th

More updates on currencies, gold & the markets after the dust settles following the FOMC announcement. G-luck.