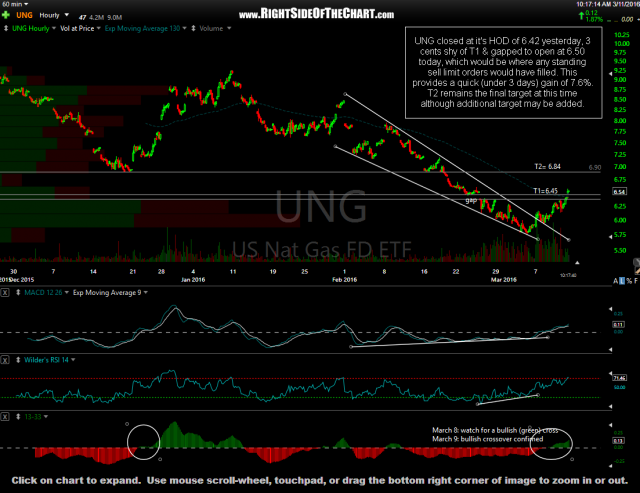

UNG (US Natural Gas ETF) closed at it’s HOD of 6.42 yesterday, 3 cents shy of T1 & gapped to open at 6.50 today, which would be where any standing sell limit orders would have filled. Any time a trade gaps beyond a target (or stop) the opening gap is where any GTC orders would fill so that is the number used to calculate the gain (or loss) on the trade. This provides a quick (under 3 days) gain of 7.6%. T2 remains the final target at this time although additional target may be added.

- UNG daily March 8th

- UNG 60-minute March11th