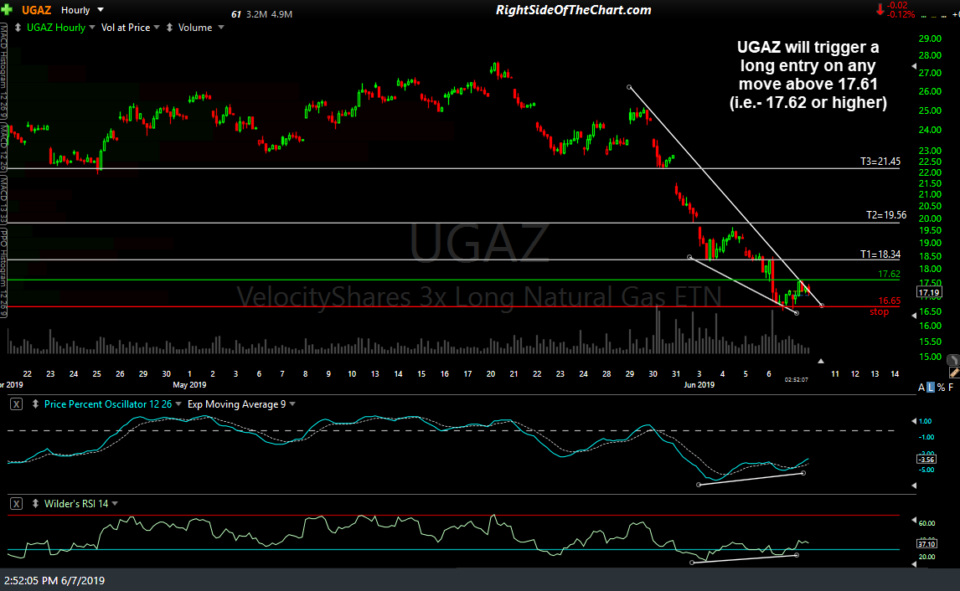

UGAZ (3x long/bullish natural gas ETN) will trigger a long entry on any move above 17.61 (i.e.- any print of 17.62 or higher). To be clear, this is a Long Trade Setup, pending an entry & not yet an Active Trade. Both UGAZ and /NG (nat gas futures) are quite oversold while setting up in a bullish falling on these 60-minute charts. As UGAZ attempts to track natural gas prices by investing in futures contracts, I’m more concerned with a breakout above the /NG wedge than than of UGAZ.

- UGAZ 60-min June 7th

- NG 60-min 2 June 7th

I set the buy trigger just above the recent reaction high on UGAZ which should roughly correlate with the recent reaction high in /NG, and if taken out, will have triggered a breakout above the falling wedge on the futures contract. I have also listed (unadjusted) price targets on the /NG chart with the arrow breaks indicating the targets (actual resistance levels) where a reaction is likely on or around the initial tag.

The price targets for UGAZ are T1 at 18.34, T2 at 19.56 & T3 at 21.45. In order to account for both the 300% leverage as well as the extreme volatility & large price swing in natural gas, the suggested beta-adjusted position size for this trade is 0.30 with a suggested stop on any move below 16.65.