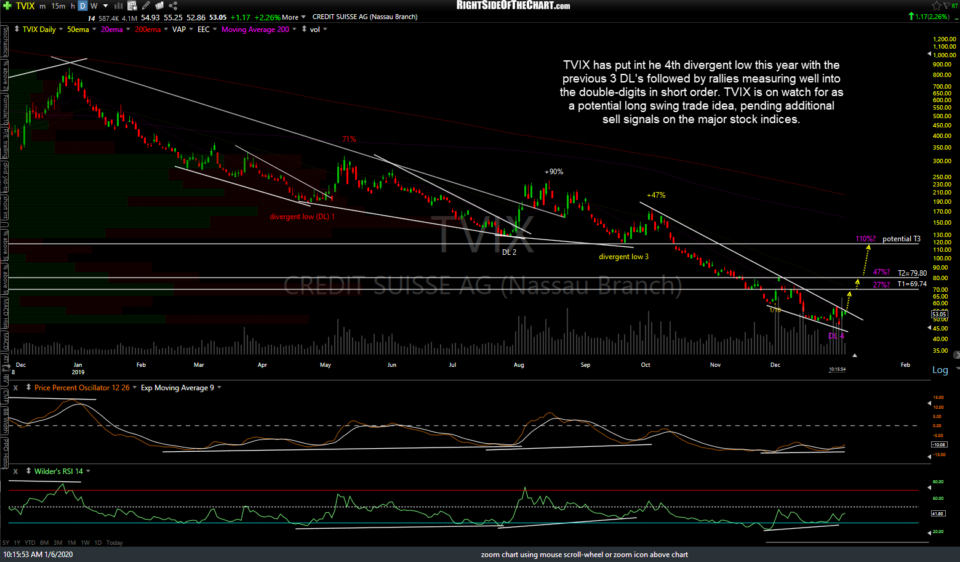

TVIX (2x VIX Short-term ETN) has put in the fourth divergent low this year with the previous three divergent lows followed by rallies measuring well into the double-digits in short order. As such, TVIX is on watch for as a potential long swing trade idea, pending additional sell signals on the major stock indices.

To be clear, this is only a Trade Setup, not an actionable or Active Trade idea at this time. So far today, the buyers stepped in to buy AAPL (and hence, the market) at the test of the bottom of the 60-minute price channel, keeping the major stock indices above the aforementioned support levels. However, QQQ has now bounced back to the 214.34 former support, now resistance level where a reversal is likely (hence, an objective short entry here with a stop not too far above). Ditto for /NQ, which has bounced back to the comparable 8811.25 resistance level.

- QQQ 60m 2 Jan 6th

- NQ 60m 2 Jan 6th

Although an aggressive, counter-trend trade that runs an elevated risk of being stopped out, one could also opt to take a starter position in TVIX here, adding to the position if/when APPL, QQQ & SPY take out the support levels highlighted in today’s previous post as well as a break above the downtrend line on TVIX.