Member @lee1 requested an update on the $TSX within the trading room. In reviewing the charts, I figured that the recent technical developments in Canada’s largest index warrants a front page post at this time.

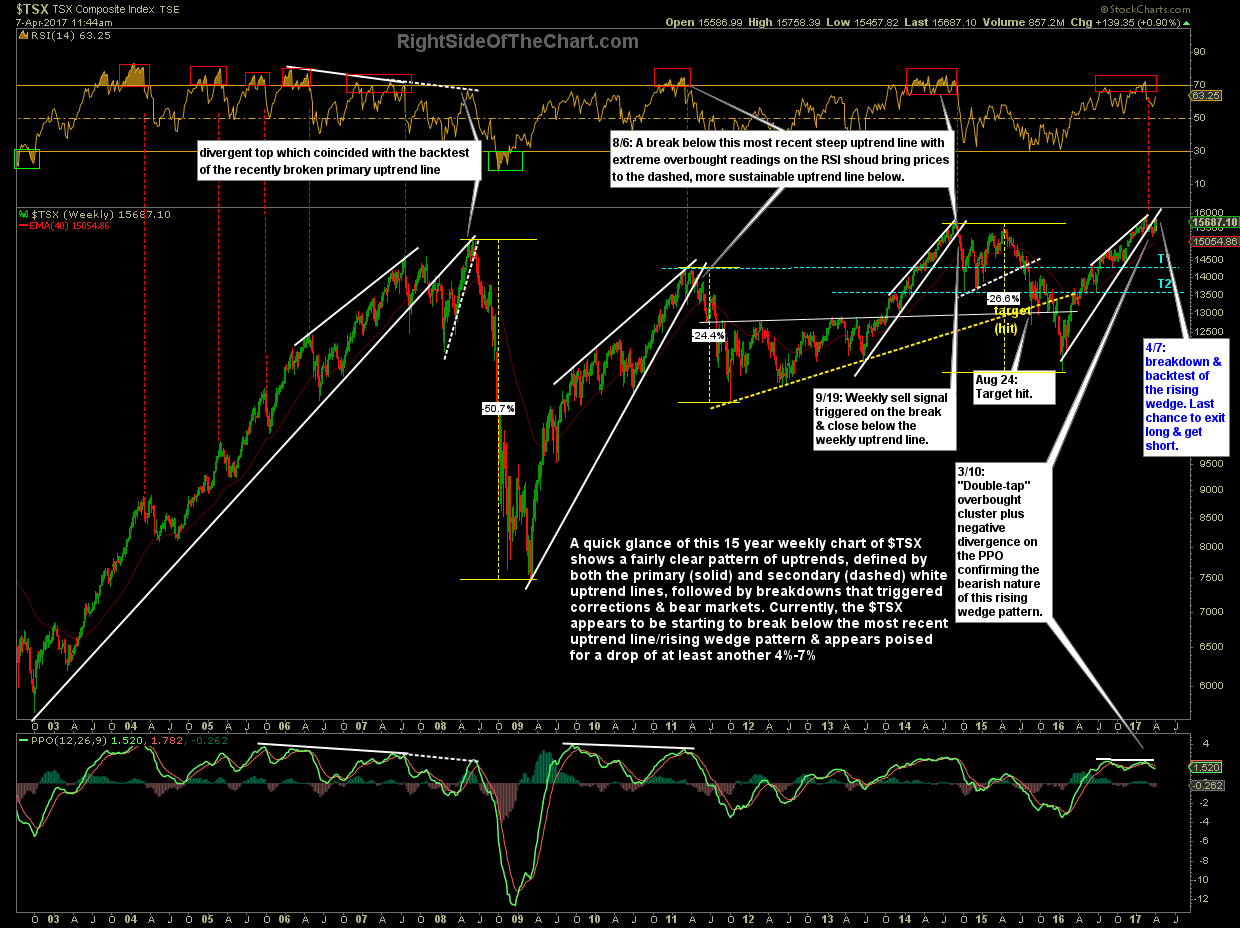

In the previous update, I had pointed out the recent ‘double-tap’ overbought cluster as well as the mature bearish rising wedge confirmed with negative divergences. Price were right on the bottom of the wedge at that time, threatening a breakdown which followed shortly afterwards. That wedge breakdown also followed a failed breakout, to new highs in the $TSX, which could prove to be a bull trap should the $TSX continue to move lower from here. The first chart above is 15-year weekly chart of the TSX Composite showing a long history of large, rising wedge patterns (4 in total including the most recent one), all of which were followed by bear markets in excess of 24%.

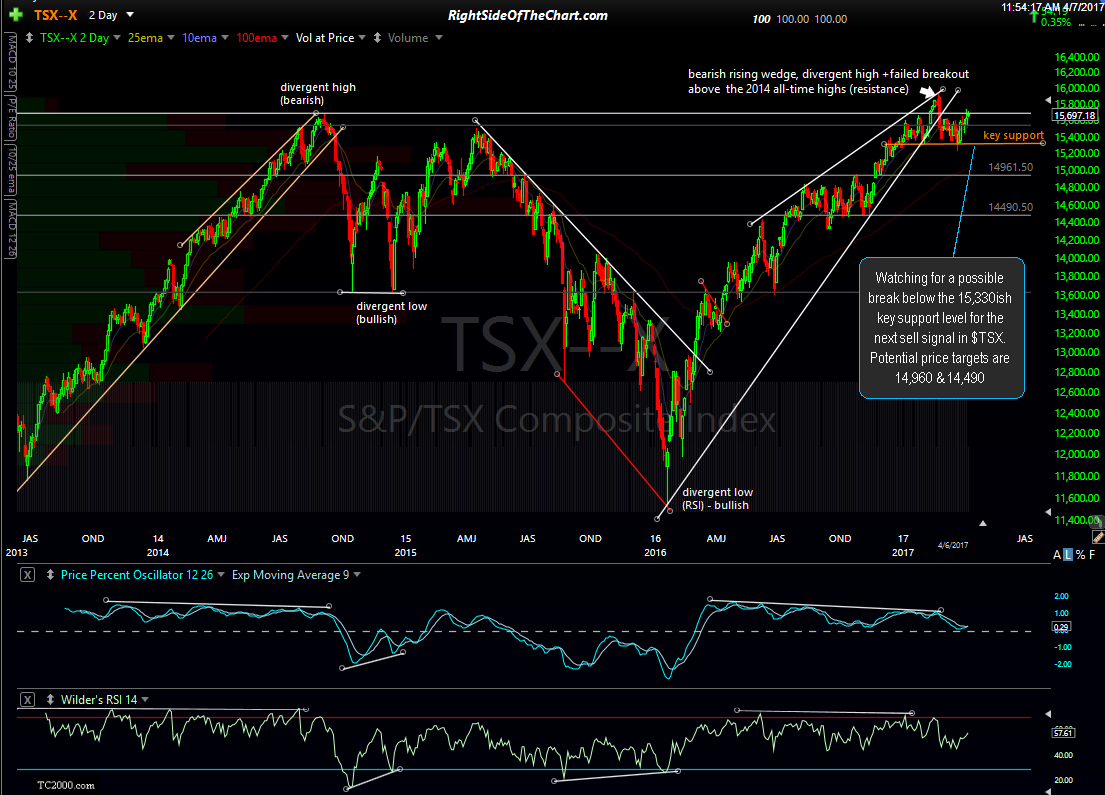

The chart above is a 2-day period (each candle represents 2 days of trading) chart spanning the last 4 years. It clearly shows the failed breakout to new highs followed by a impulsive move lower & a breakdown below the primary uptrend line off the Jan 2016 lows (which makes up a large bearish rising wedge pattern). I’ve also added a key support level that comes in around 15,330 which is likely to spark an impulsive wave of selling, if that level is taken out in the coming weeks/months. If that level is taken out with conviction, the potential price targets are 14,960 & 14,490.