Yesterday, in the trading room, I posted the following regarding what I believe to be the case for an objective short trade on TSLA:

TSLA starting to look interesting as a short from an R/R perspective with the technicals possibly confirming (if the divergences on the daily hold today).

My immediate reaction to yesterday’s headlines when they broke was that the “genius”, Musk, may actually be a fool, based on what he tweeted. My initial thoughts were that his tweet was an impulsive attempt to blow out some shorts & boost TSLA’s share price but a CEO of such a large company would certainly know better than to make false material statements which would be committing securities fraud, but then I said to myself; “No way he could ever do such a foolish thing.”

An article published in the WSJ last night concurred that IF what he said was not true (he has already secured the funding required to take the company private at $420), Musk, and the company, could be in serious hot water.

Maybe what he said is 100% true & if so, that would put about $32 points, or just over 8% upside on the stock from the $387.92 that it traded yesterday but a WHOLE LOT MORE downside, should it turn out that he made some impulsive untrue statement with false material facts. Maybe not the highest probability of success on a TSLA short around $390 but from an R/R perspective, especially if the $420 private buyout scenario A) is real but doesn’t materialize (still a lot of work/shareholder approval, etc.. required) or B) was a lie (bottom falls out of the stock with possible jail time from Musk & lawsuit city for the company) sure seems compelling.

As of now, the technical case for a short on TSLA continues to firm up with the stock (and Musk’s pump & squeeze attempt) now having clearly failed Tuesday’s tweet-induced pop & failed test of the previous all-time highs from back in June & Sept 2017 (now a triple top so far).

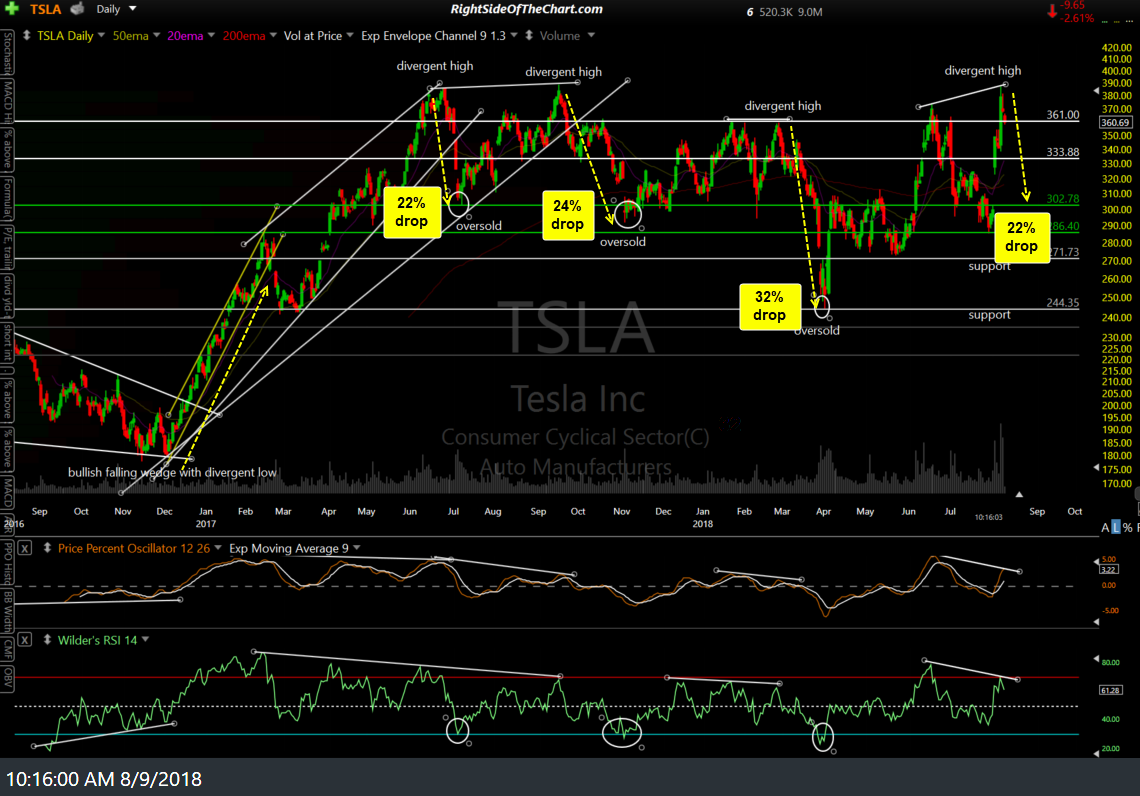

While there is still some work to be done to firm up the case for a lasting top in TSLA, as the stock has now pulled back to the key 361 support & is still within relative close proximity to a new all-time high, the potential divergences that were highlighted yesterday as well as the case for a much larger drop, should it the current SEC probe prove that Musk made an impulsive & false statement regarding having already secured financing to take the company private at $420, are now even closer to being confirmed via a bearish crossover on the PPO.

The chart above highlights all previous divergent highs over the past 2 years (as well as the divergent low in late 2016 that was followed by a 117% rally). The previous 3 divergent highs were followed by corrections of 22%, 24% & 32%. Based on my current preferred swing target of 302.80, my expectation at this time is for a drop of about 22% off Tuesday’s highs.

Due to all the current buzz surrounding Tesla at this time, including the potential for large news-induced price swings, this remains an unofficial trade idea at this time & should be considered an aggressive trade. While unofficial trade ideas typically don’t provide exact price targets, a suggested stop & a beta-adjusted position size, I will say that my personal stop on this trade is any close above 395 & my price targets are T1 at 325.80, T2 at 303.12 & T3 at 275.85. I also plan to lower my stop to breakeven or below, as/if the stock continues lower.

Assuming that this trade pans out, how much of the position, if any, that I will cover at any of those price targets will depend on how the charts & news of the SEC probe develop going forward. Also, keep in mind that my stop is based off my average cost basis which consists of two lots so far (one yesterday morning & another today). Ideally, stop-losses should be set depending on one’s unique entry price(s) relative to their preferred price target(s).