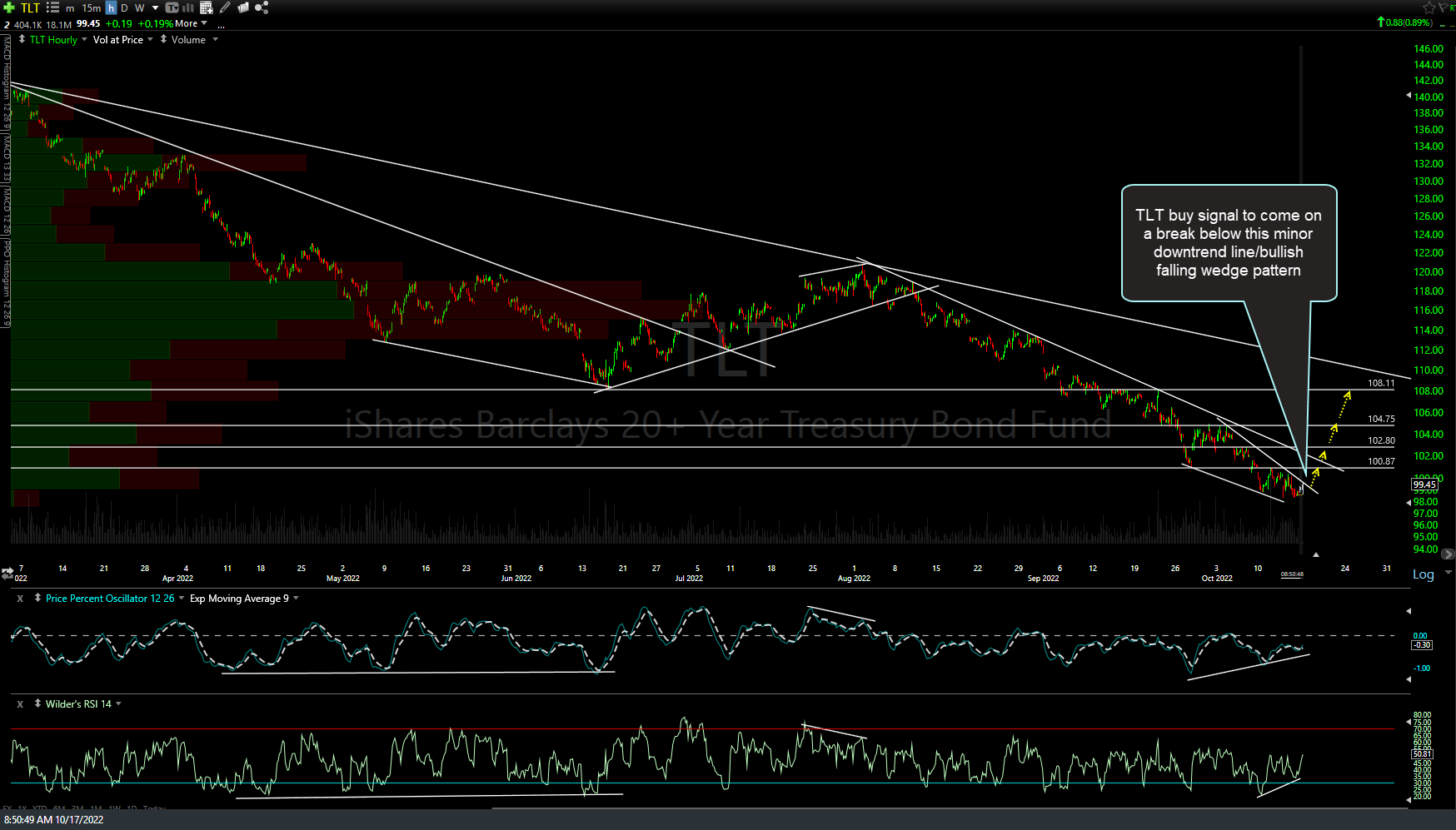

TLT (20-30-yr Treasury bond ETF) buy signal to come on a break below this minor downtrend line/60-minute bullish falling wedge pattern with price targets denoted at arrow breaks.

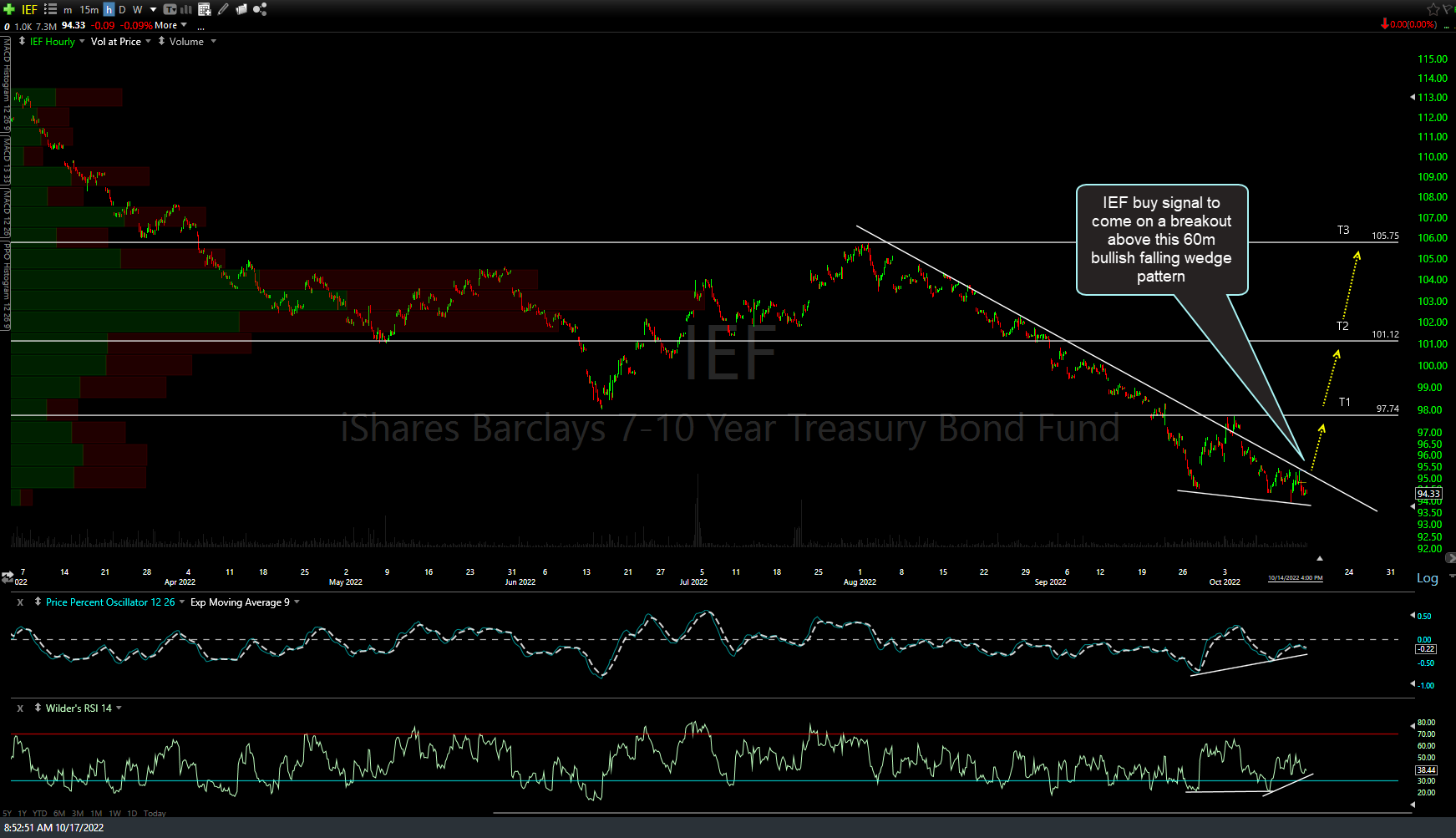

IEF (7-10 yr Treasury Note ETF) buy signal to come on a breakout above this 60-minute bullish falling wedge pattern.

Buy signals 1 & 2 to come on breakouts above these two downtrend lines on this 60-minute bullish falling wedge pattern of IEI (3-7 yr Treasury Note ETF).

Keep in mind that Treasuries are less volatile than the stock market & as such, I will make a considerable beta-adjustment to my positions on the upside; i.e.- roughly 2x-4x what my typical exposure the major stock indexes (/NQ, QQQ, SPY, /RTY, etc..).

As mentioned recently, I’ve been using long positions in various maturities (5, 10, & 30-yr) Treasuries as an indirect hedge to the swing shorts in my longer-term accounts.

T-bond futures (/ZB, /ZN, /ZF, etc..) are already leveraged so one would take that leverage factor into account when determining position size whereas the 3 ETNs above are not. One can use this Position Size Calculator that I created to help determine the amount of T-bond ETFs or futures (although the multiplier must also be factored in on the latter).

Treasuries have been trading with a fairly strong positive correlation to the stock market since the bear market started nearly a year ago although I suspect that at some point going forward (for various reasons), we are likely to see a return to the typical inverse correlation (stocks down/bonds up & vice versa) although for now, the positive correlation remains.

Regardless, the potentially bullish setup in Treasury bonds both from a technical & fundamental perspective makes the R/R profile on these setups (or active trade ideas, for those that have already started to scale in, as I have) one of the most attractive of the major asset classes that I see at this time. i.e.- The downside in Treasuries from here appears relatively minimal compared to the upside potential IMO.

I can’t say the same for the stock market as I still believe the risks have shifted from mostly unilateral (i.e.- the downside risk for months outweighed the upside potential) to more bilateral over recently (the odds for a potentially strong reversal & rally are close to the odds for another sharp leg down).