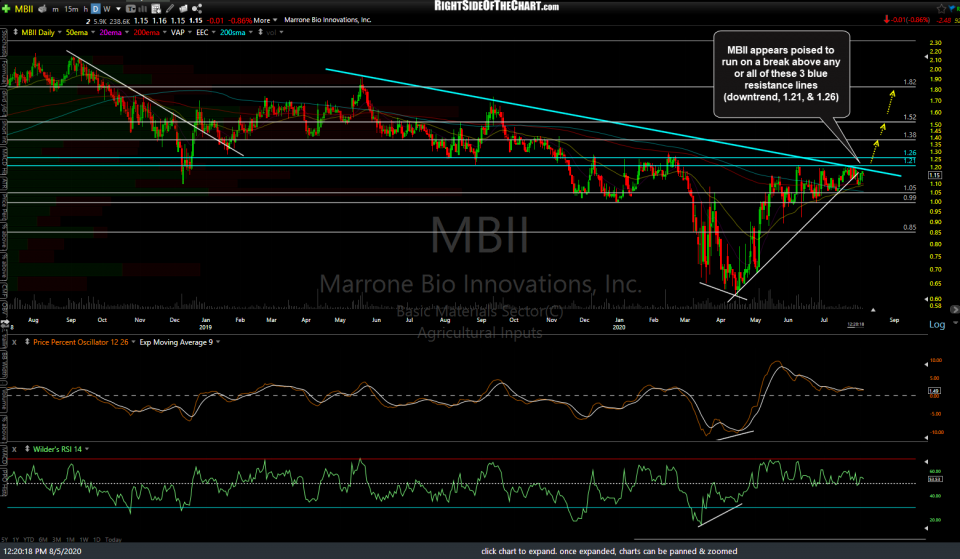

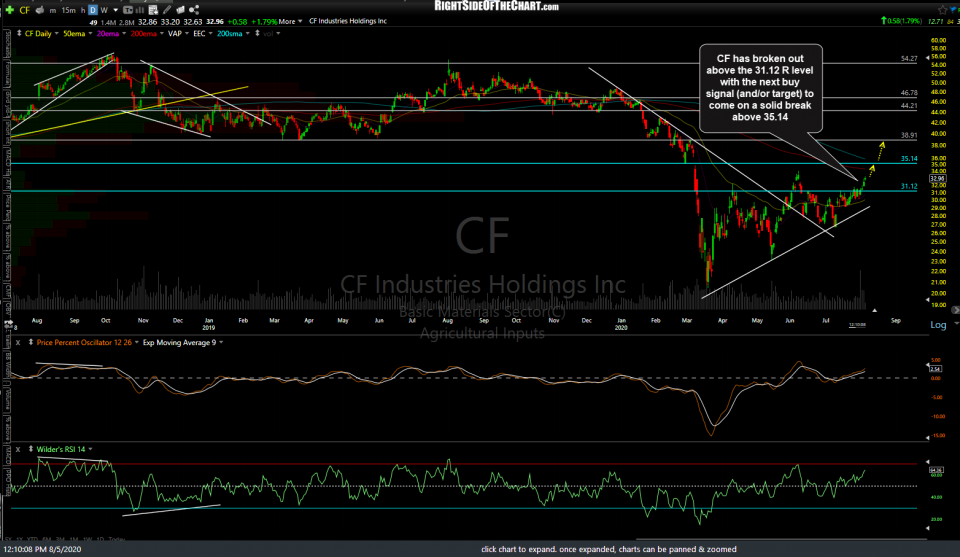

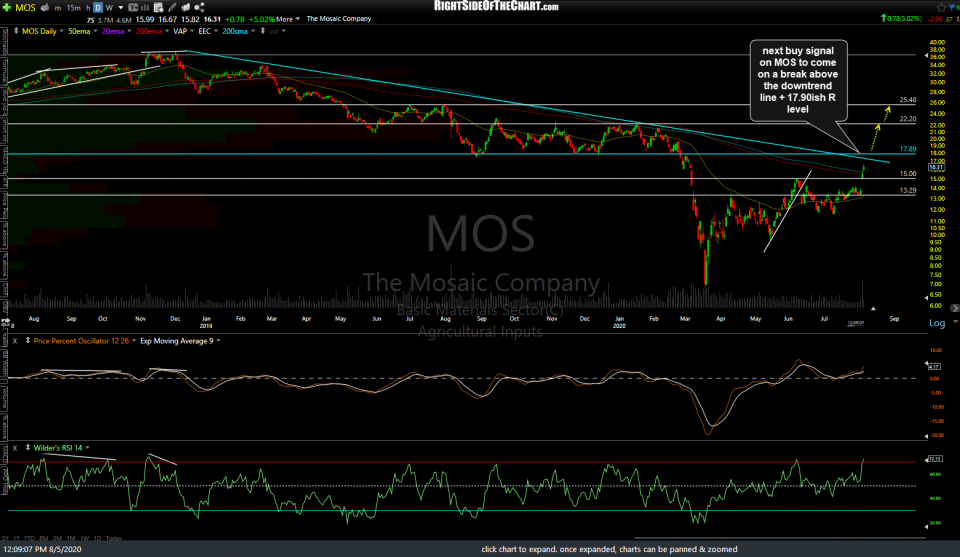

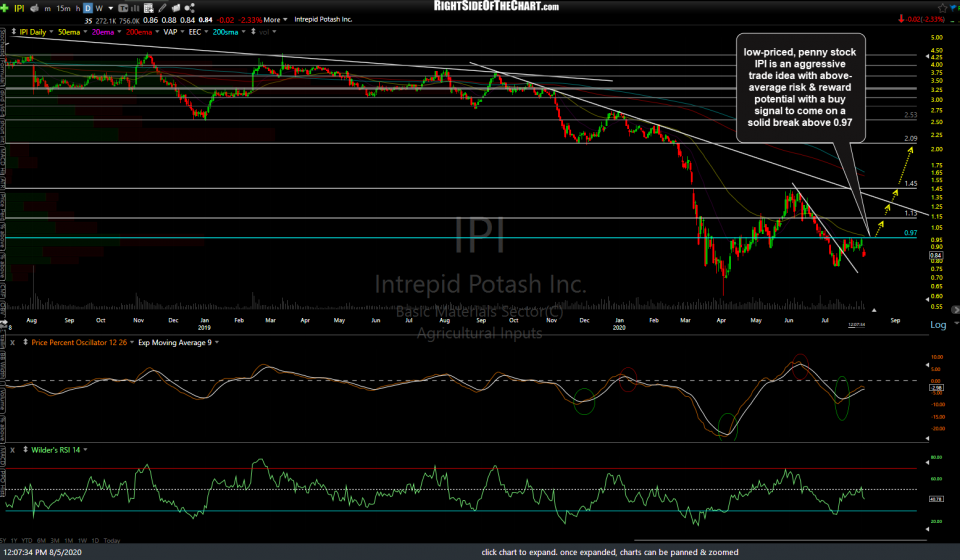

The following trade ideas below are various stocks in the agricultural input sector which is likely to rally if the recent gains in the agricultural commodities continue in the coming months, as I expect it will. The blue lines on each chart below show the resistance level(s) which is(are) likely to spark a rally (i.e.- a breakout or objective long entry trigger points), if & when taken out. The marked resistance levels overhead are potential unadjusted* price targets with pullbacks to any of the marked support levels below also providing objective entries or add-ons to an existing position (on those trades which have already triggered a buy signal).

MBII appears poised to run on a break above any or all of these 3 blue resistance lines (downtrend, 1.21, & 1.26).

CF has broken out above the 31.12 resistance level with the next buy signal (and/or target) to come on a solid break above 35.14.

The next buy signal on MOS to come on a break above the downtrend line + 17.90ish resistance level.

As a low-priced, penny stock IPI is an aggressive trade idea with above-average risk & reward potential with a buy signal to come on a solid break above 0.97.

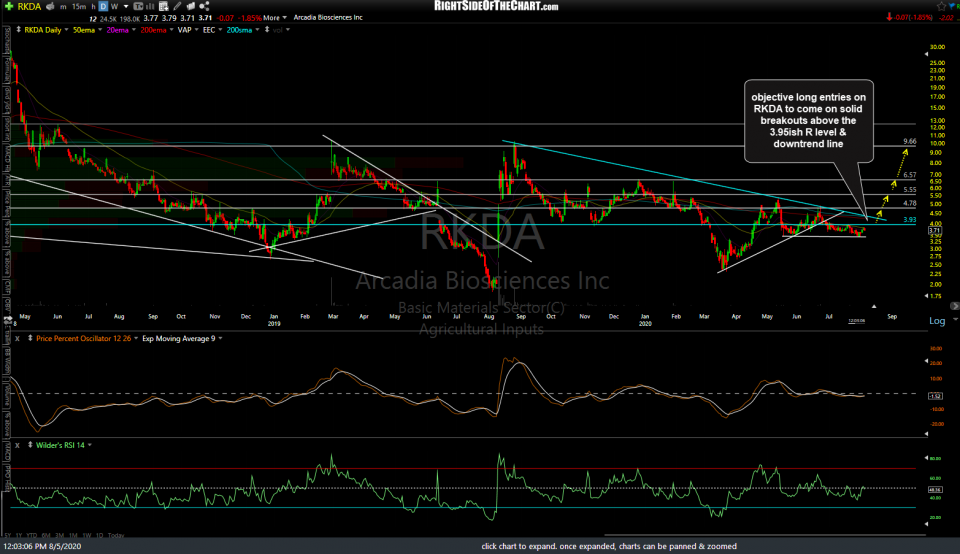

Objective long entries on RKDA to come on solid breakouts above the 3.95ish resistance level & downtrend line.

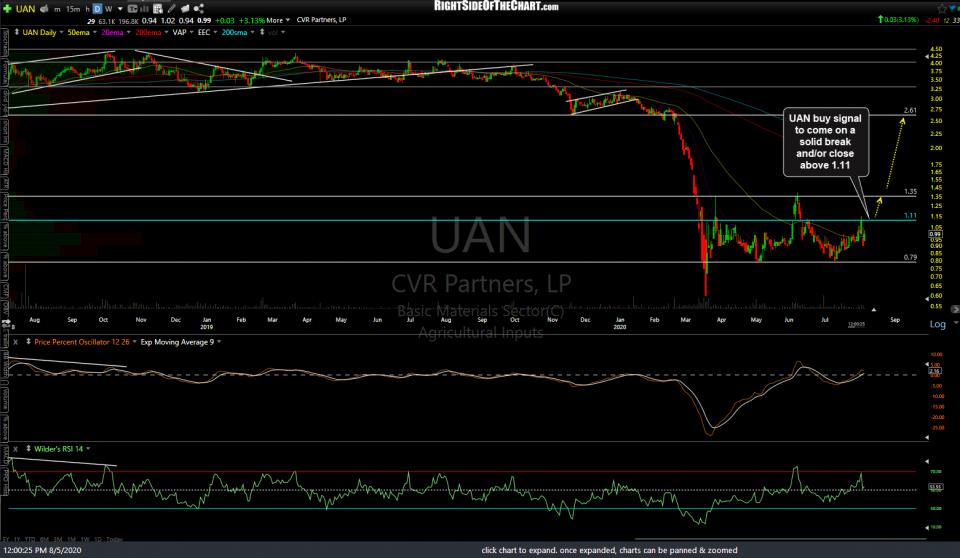

UAN buy signal to come on a solid break and/or close above 1.11.

AVD buy signal triggered on this breakout above the downtrend line/triangle pattern.

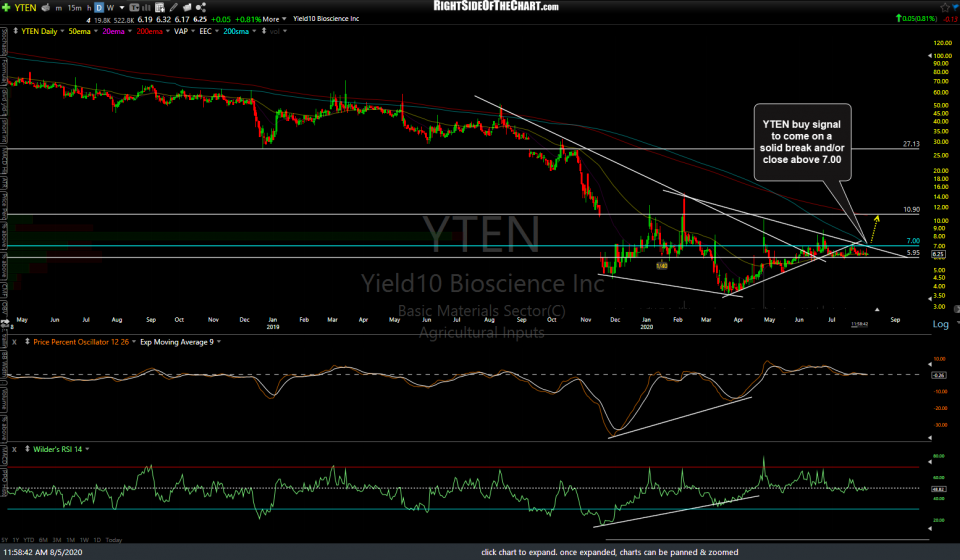

YTEN buy signal to come on a solid break and/or close above 7.00.

CGA buy signal to come on a solid break above the intersecting downtrend line + 3.10ish resistance levels.

SEED was highlighted as a standout long trading opp along with most or all of the stocks above shortly before & after the buy signal on the breakout above this downtrend line back on June 3rd, rallying 260% in less than 2-months & now poised for a correction. However, with the charts of most stocks within the sector starting to firm up, I don’t care to short SEED, rather I wanted to reiterate this would be a good time to book profits for those that took the trade and/or tighten up stops, if holding out for additional gains.

*Unadjusted price targets are the actual resistance level in which a reaction upon the initial tag from below is likely. I find it best to set my sell limit orders slightly below the actual resistance level in order to minimize the chance of missing a fill, should the sellers step in a bit early.