Too aggressive to meet the criteria for an official trade idea but for those interested, I just took a small position in TNDM at 1.01. It has been my experience that companies will often vigorously defend their stock price to keep it above the 1.00 level for several reason (avoid delisting notices from the exchange, avoid the stigma of become a ‘penny’ stock, etc…). A company can, and often will, defend the stock price buy the insiders buying shares, the company buying shares, or reverse stock splits, the latter of which only increases the share price but dilutes the shares proportionately.

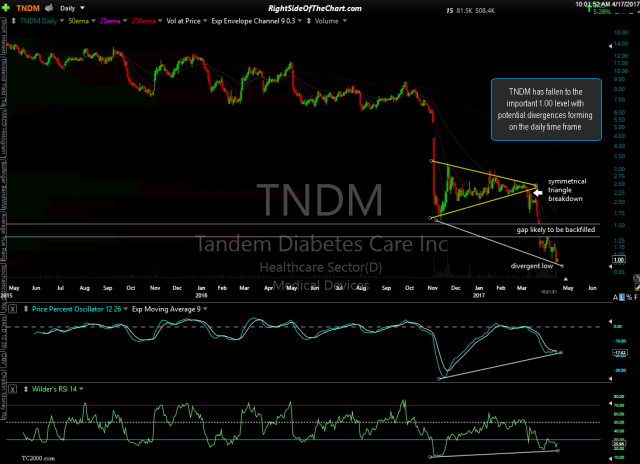

- TNDM daily April 17th

- TNDM 60-min April 17th

This is most certainly a highly aggressive trade idea with TNDM clearly entrenched in a vicious bear market that has wiped out nearly 97% of this companies value from its early 2014 highs so pass if catching falling knives is not within your comfort level or trading style. The first chart above is a daily chart showing the strong potential (but still unconfirmed) divergence with the second chart being the 60-minute chart, also showing potential positive divergence beneath a bullish falling wedge pattern. Horizontal resistance levels shown are potential price targets unadjusted for an optimal fill. Best to set your sell limit order(s) a penny or two below your preferred target. My preferred target at this time is to sell 1/2 my position just below the 1.30 level if it gets there soon, raising stops on the second half to protect profits while holding out for a possible gap back-fill.