TLT (20+ Year Treasury Bond ETF), which was recently posted as an unofficial trade idea, mainly because we were already long IEF, the 7-10 year Treasury Bond ETF, has already hit the first price target for a total gain of 1.90% which equates to a beta-adjusted gain of 2.9% – 3.4% beta-adjusted gain, as the beta-adjusted position size for this relatively low-risk/low-volatility trade was 1.5-1.8 (50-80% higher than a typical position size).

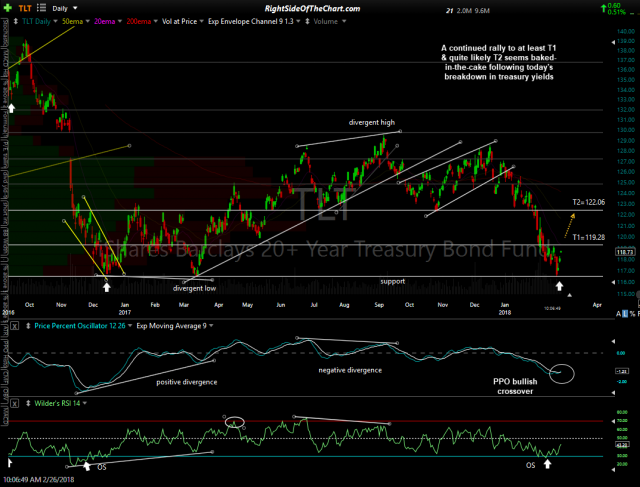

- TLT daily Feb 26th

- TLT daily March 1st

My expectations for TLT are in alignment with at least my near-term expectations for the stock market. That would be a pullback in TLT here on this initial tag of the first target, which was set just below the actual resistance level around 119.35, followed by another & likely final thrust up towards the 122 area before a resumption of the downtrend. Should TLT pullback from here, it would likely coincide with SPY reversing off the bottom of the support zone that has been highlighted as a potential pullback target in recent weeks, which so far seems to be playing out as per the scenario covered in today’s video as well as with the charts & commentary posted in the comment section below that post a short while ago.

The reason these scenarios for two completely different assets classes are in alignment is that treasury bonds, particularly during periods of market turmoil & sharp selloffs, often have an inverse correlation to the stock market (one goes up, the other goes down & vice versa). This is due largely to the fact that treasury bonds are a flight-to-safety instrument, with institutions moving money from stocks to bonds to avoid/minimize any further losses.

Note: As an unofficial trade, the posts associated with this trade will not be assigned to the Completed Trades archive now or if/when the final target is hit. Only official trades are re-assigned to the Completed Trades archives when one or more profit targets and/or the suggested stop is hit.