The Trump Pump, which reminds me a lot of the Brexit Dump in reverse, a surprise vote that immediately caught the market off-guard, resulting in sharp sell-off that was quickly followed with an equally sharp market ramp that faded all of the post-Brexit sell-off & then some. Funny how on the night of the presidential elections, I kept the real-time polling results up on one monitor with a streaming chart the US stock index futures on another screen. The future’s reaction to the polls were unmistakable & very pronounced: Every time Trump took a state, the futures immediately moved sharply lower & vice versa when Clinton took a state. As the evening went on & it became clear that Trump was pulling ahead & almost assured to win, the futures completely tanked. I know that many traders here were already aware of that, with several posting about how the futures were trading on election night. What I wanted to share, besides the technical developments below, are my thoughts or theory on the price action in the market since the elections.

Although there are varying degrees, for the most part, traders can be broken down into two groups: Professional traders (aka- the smart money) and retail traders (often referred to on the street as the dumb money). Again, simply generalizing, it is the smart money that trades stock futures & other more complex financial instruments, both during and after the regular trading session while the retail traders, for the most part, stick to trading individual stocks & ETFs during the regular trading session (9:30 am – 4pm ET).

Funny how the futures, tick-by-tick, were clearly pricing in a Trump presidency as bearish yet in the days immediately following the election, the market rallied instead to selling off. As was highlighted last week, that rally was largely attributed two just two sectors that were/are perceived to be the likely beneficiaries of a Trump presidency; Healthcare (a la the potential repeal of Obamacare, to some extent or another) & the Financials (a la the repeal of Dodd-Frank, again to a some extent or another). I’ve already share my thoughts, or skepticism on just how likely any meaningful changes to Obamacare & Dodd-Frank, as well as both the time it would take and most importantly, the impact that any changes to either of the above will affect to the bottom line (fundamentals) of the companies like banks & biotech stocks which have literally seen explosive rallies in the wake of the election, again, largely responsible to the recent gains in the market.

Only time will tell if I am correct & the Trump Pump in the healthcare & financial stocks was overdone or simply the beginning of a new major wave up in those sectors. My theory, based on the difference between how the futures reacted to a Trump win vs. the voracious appetite for any stock or ETF related to a bank or healthcare company, particularly the biotechs, was that last week’s post-election feeding frenzy may have been largely driven by retail investors, which are those that typically buy at market tops & sell at market bottoms. While fundamentals certainly have their place in long-term investing (and again, the potential fundamental impact on the sectors mentioned above still just a massive wild-card/unknown), when it comes to trading & trying to figure out where the market is likely headed in the near-term (days, weeks & months), the charts are a much more reliable indicator.

One of the most important developments in recent weeks as been a clear deterioration in the former market leading stocks such as GOOG/GOOGL, AMZN, FB, etc.. This recent deterioration in the market leading stocks, a trend that has historically occurred at major market tops, can be evidenced by the recent underperformance of the former leading index, the Nasdaq 100, which closed last week well off its high while the Dow Jones Industrials exploded to new highs last week. Interestingly enough, 1/3rd of the returns from the DJIA come from stocks in the financial & healthcare sector such as JPM, GE, GS, JNJ, PFE & UNH, all of which had huge post-election rallies yet the Nasdaq 100, which does not hold any financial stocks, closed the week below pre-election levels despite a 15% weighting to the healthcare sector which experienced one of its biggest two-day winning streaks in years.

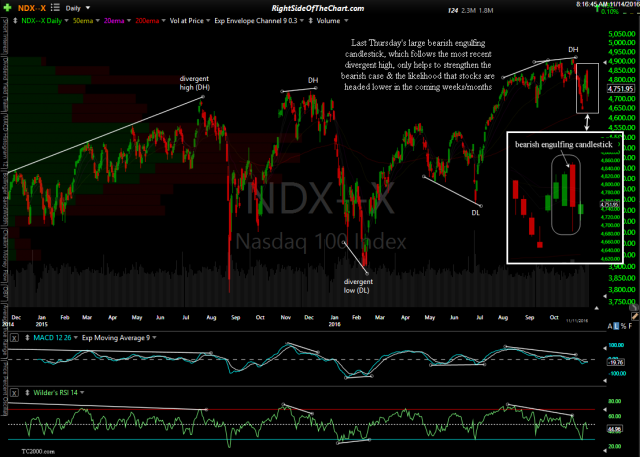

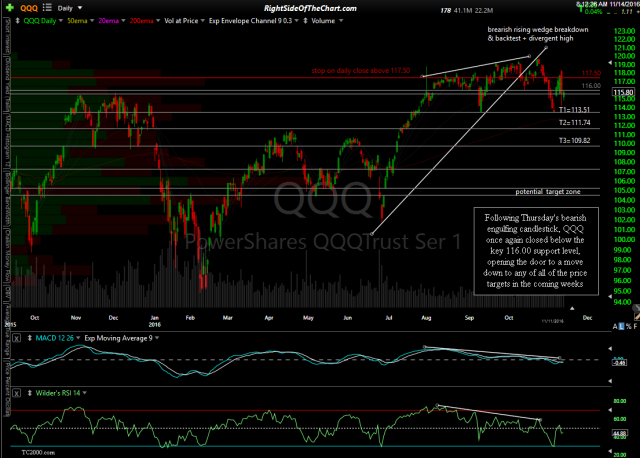

Moving on to the charts of the Nasdaq 100, last Thursday’s large bearish engulfing candlestick, which follows the most recent divergent high, only helps to strengthen the bearish case & the likelihood that stocks are headed lower in the coming weeks/months. It is also worth noting that following Thursday’s bearish engulfing candlestick, QQQ once again closed below the key 116.00 support level, opening the door to a move down to any of all of the price targets in the coming weeks.

- $NDX daily Oct 11th close

- QQQ daily Nov 11th close