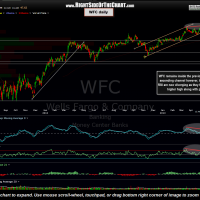

Regardless of the relentless bid under the market lately, the Too Big To Fail banks still look bearish from a technical perspective at this point. Although the current divergences and bearish price patterns can & will be negated should prices go much higher, at this time these key financial stocks have not yet reached that point (of undoing the bearish technicals).

I realize that the will of most flexible/short-side traders has been broken lately with the markets powering to new highs on a near-daily basis in spite of bearish chart patterns and divergences. There are times where technical analysis simply doesn’t work and usually that happens to bullish patterns during a downtrend and bearish patterns during an uptrend (as is currently the case). Therefore, one should be very selective with any short-side trades until we at least return back to a short-term downtrend once again. At this time, the trend on all major time frames (long-term, intermediate-term and short-term) is clearly up.

With that being said, I always strive to keep both long and short trade ideas on the site as even during a strong trend, some traders or investors might be looking for counter-trend trades to hedge their existing positions or maybe an aggressive trader is looking to position in front of what could be a sudden reversal. As I plan to continue to remove many of the existing short trades that no longer look attractive, I am going to add all 4 of these stocks as Active short trades at current levels with stops & targets to follow asap. Essentially, the stops will be very tight as these stocks are approaching the upper-limits of where the bearish technicals will become undone. For example, if prices were to make a solid move back inside of a bearish wedge or the MACD and RSI both take out their downtrend lines. Therefore, in spite of “the trend that just won’t end”, I view these 4 stocks to be objective short entries here with the appropriate stops in place. Objective should not be confused with a high probability of success. Rather that the expected measure of loss, if wrong, is more than outweighed by the potential gain on the trade, if correct. With BAC, for example, I’m looking for a 30% correction from current levels but my stop will be less than 10% overhead. Updated daily charts of JPM, BAC, C, & WFC: