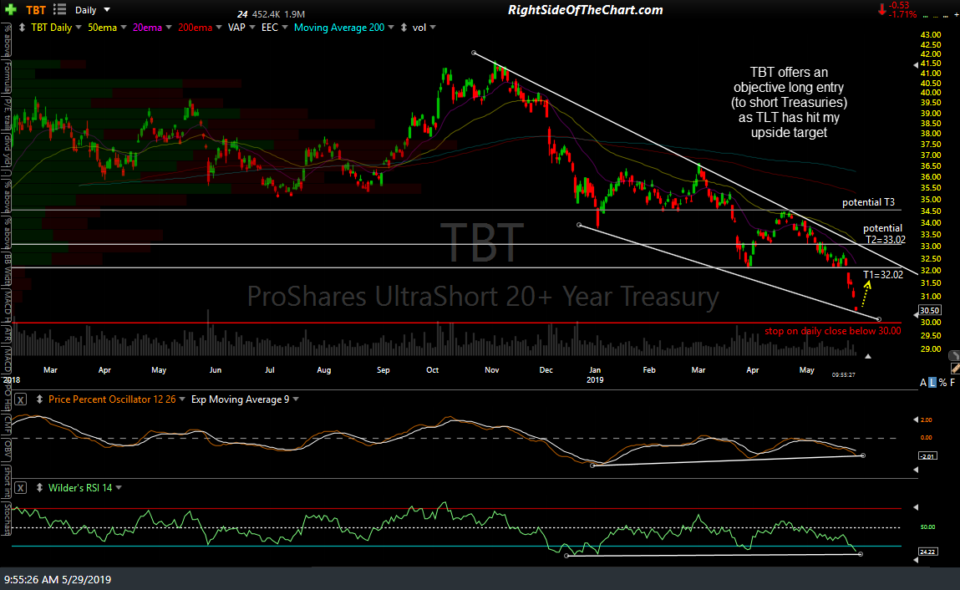

TBT (2x short Long-term Treasury Bond ETF) offers an objective long entry (to short Treasuries) as TLT has hit my upside trend target with a tradable pullback is likely to follow. To clarify, one would buy or go long TBT to short Treasury bonds. As such, this trade is now an Active Short Swing Trade.

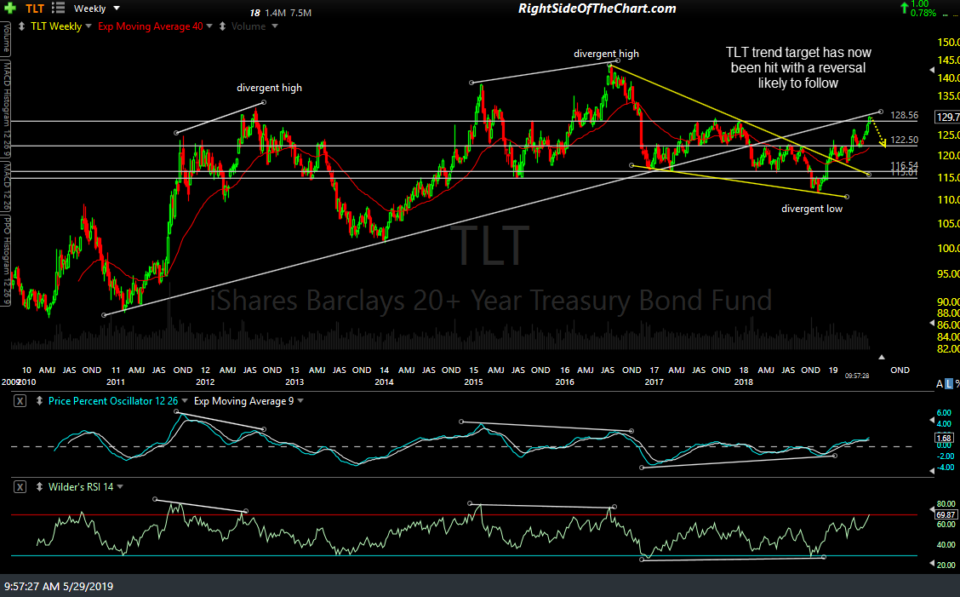

At this time, the sole price target for this trade is T1 at 32.02 with the potential for additional price targets to be added, depending on how the charts develop going forward. The suggested stop for this trade is a daily close below 30.00 and the suggested beta-adjusted position size for this trade is 1.0*. One could also opt to short a 2x position on TLT. Previous & updated TLT weekly charts below:

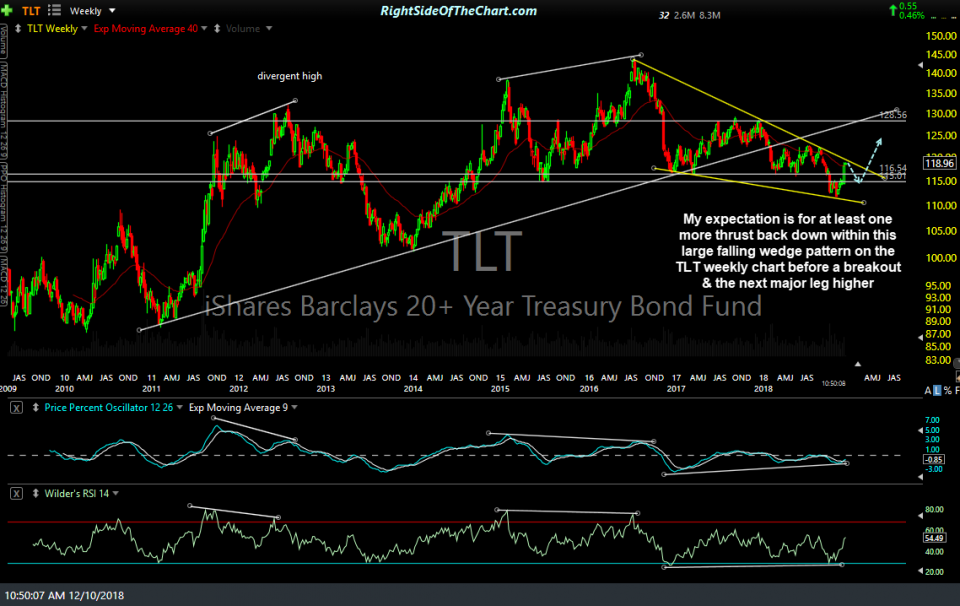

- TLT weekly Dec 10th

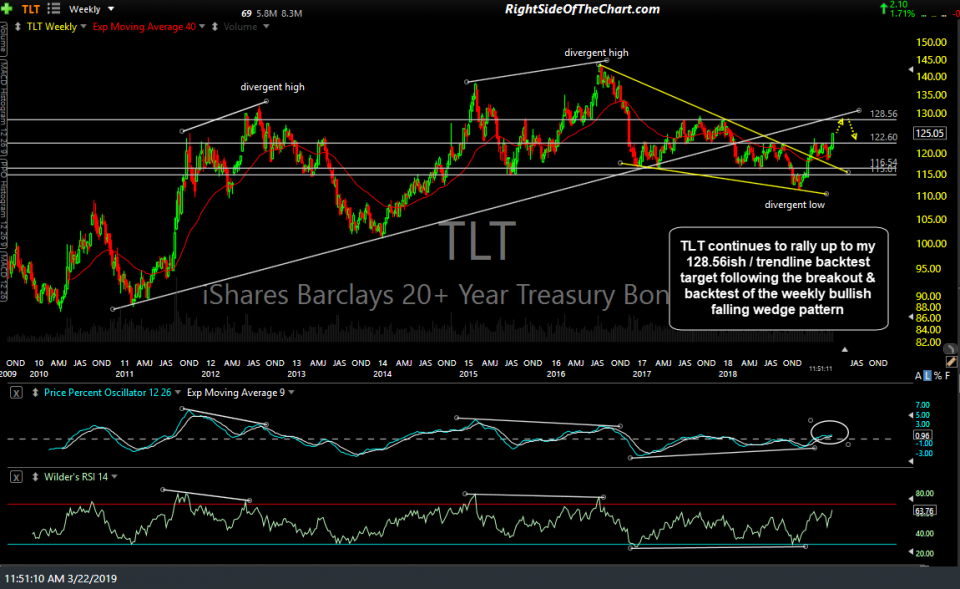

- TLT weekly screenshot 3-13-19

- TLT weekly March 22nd

- TLT weekly May 29th

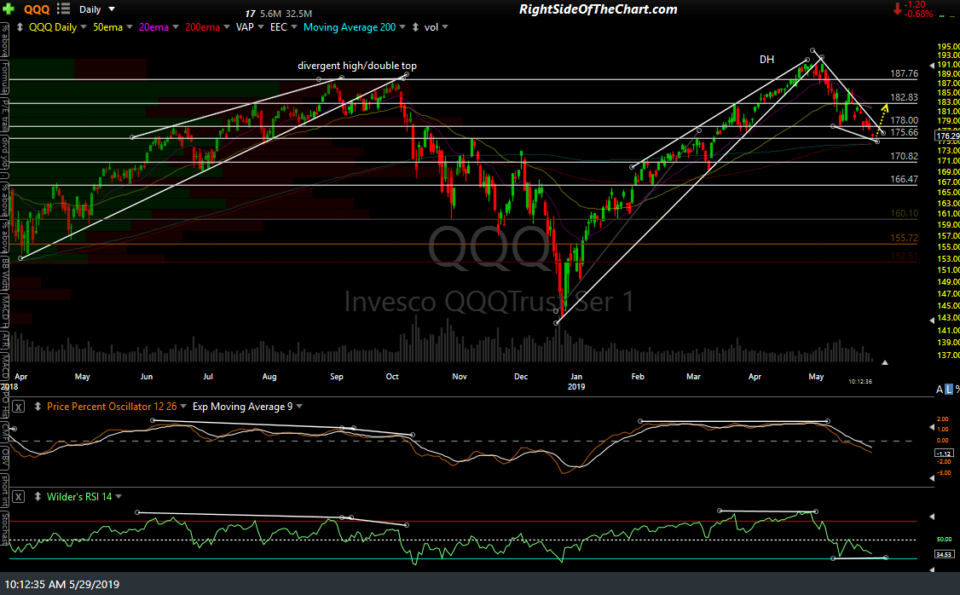

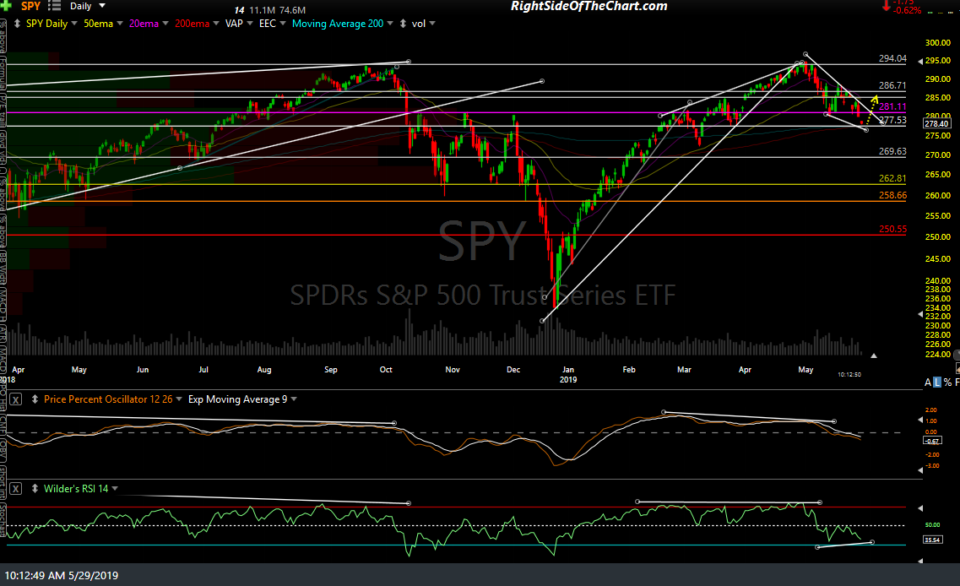

Although not necessary, a correction in US Treasury bonds would most likely align with the bounce in the equity market off the support levels that mentioned in today’s previous post (SPY 277.53 & QQQ 175.66). Daily charts below:

- QQQ daily May 29th

- SPY daily May 29th

*A 1.0 beta-adjustment on a 2x leveraged ETF such as TBT equates to a 2x average position size. As Treasury bonds are inherently much less volatile than equities, a 2x position size is about average for a position in Treasury bonds.