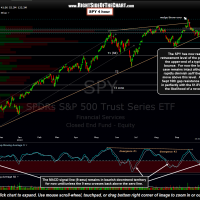

The SPY has now reached the 61.8% retracement level of the previous move lower, near the upper-end range of a typical counter-trend bounce. For now the longer-term bearish case remains intact although it will begin to rapidly diminish as/if the SPY continues to move above this level. Also notice how the Sept 16th gap resistance (dotted line) comes in perfectly with the 61.8%, further increasing the likelihood of a reversal off this level. The Q’s are backtesting the rising wedge from below as the SPY hits the 61.8% retracement level. Although I still favor a resumption of the downtrend from at or near current levels, the technical picture remains mixed at this time and as such, we probably won’t get a good idea on where this market is headed next until next week. Updated SPY & QQQ 4-hour charts:

- SPY 4-hour Chart

- QQQ 4-hour Chart