QQQ (Nasdaq 100 tracking ETF) appears poised to rally on a solid break above the 217.50ish resistance level with a minimum bounce target of the 224ish level which would account for a gain of about 3% if hit. Also, note the positive divergence currently in place on this 30-minute chart below.

After falling to & reversing off the 8701.50ish target last night while putting in a divergent low, /NQ (Nasdaq 100 futures) have rallied back to the 8940-8950ish resistance level with a solid break above likely to spark a rally to at least the 9044 resistance level & quite likely the 9213-9245 resistance zone.

Just to reiterate once again, resistance is resistance until & unless broken so the charts above are trade setups. A long trade setup is a potential trade awaiting an objective entry pending a breakout above resistance and/or a bullish chart pattern. The near-term trend is still clearly bearish by nearly all metrics and stock indices could certainly fail here on this bounce back to resistance followed by another leg down.

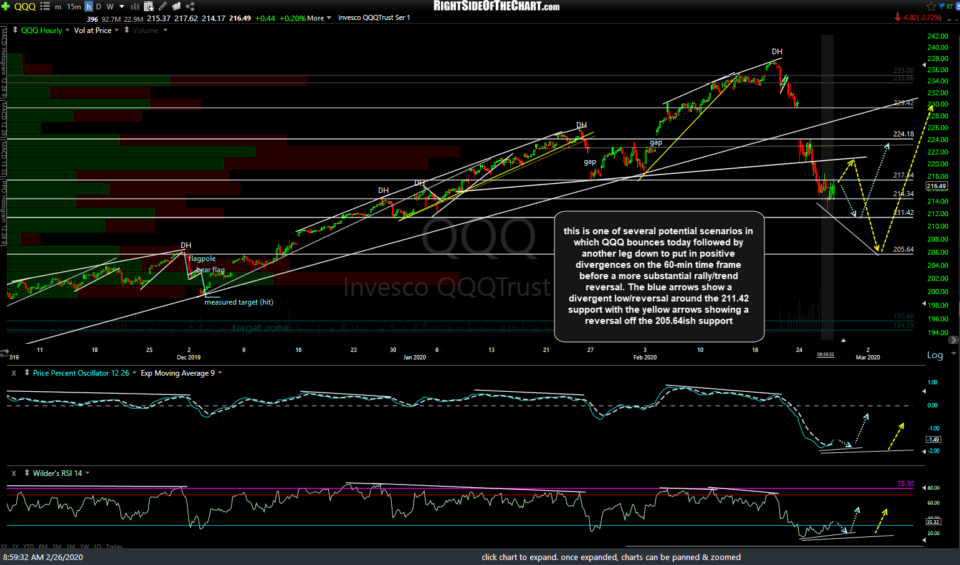

Although there is no shortage of potential paths the stock market can take from here, the two very similar scenarios above highlight a likely outcome if QQQ pops the aforementioned resistance levels but only rallies about 1½% followed by a reversal off the intersecting 220.25 + trendline resistance levels (or slightly higher/lower) with another leg down to the next decent support levels (211.42 & 205.64) to put in a divergence low on the 60-minute time frame (QQQ only has divergence on the 30-minute charts right now although /NQ does have divergence on the 60-min charts).

My goal in presenting alternative & (almost) opposing scenarios is not to provide confusing or conflicting analysis… nor a “plan A” and “plan B” in which to jump in whichever one plays out with an “I told you so…”, rather to lay out the salient technical levels & developments that are likely to determine the next “micro-trend” (rally or drop) in the market, depending on how the indexes act when reaching each of those support & resistance levels such as the 217ish resistance level that QQQ is currently testing in the pre-market session. Active traders need to stay flexible & adapt/adjust as the charts develop. Best of luck on your trades today.

-rp